Community Banking in the 21st Century

The third annual Federal Reserve System/ Conference of State Bank Supervisors Community Banking in the 21st Century Research and Policy Conference took place September 30 - October 1 at the Federal Reserve Bank of St. Louis. The research conference will brought together community bankers, academics, policymakers, and bank regulators to discuss the latest research on community banking.

The Federal Reserve/CSBS research conference presents an innovative approach to the study of community banks. Academics explore issues raised by the industry in a neutral, empirical manner and present their findings at the conference. Community bankers contribute through participation on discussion panels and feedback to the research presented, by contributing to an annual national survey, and by serving as keynote speakers at the conference.

Federal Reserve Governor Jay Powell gave opening remarks at the fourth annual conference. Other guest speakers included CSBS President and CEO John Ryan and Federal Reserve Bank of St. Louis President James Bullard.

The call for papers for the 2015 conference opened Feb 2, 2015.

For more information, please contact conference@communitybanking.org.

Conference Agenda

Gateway Auditorium, 6th Floor | Federal Reserve Bank of St. Louis

September 30 - October 1, 2015

- Wednesday, September 30

-

Welcoming Remarks

-

Research Paper Session 1

Community Bank Discussant PresentationThe Changing Role of Small Banks in Small Business LendingLamont Black and Michal KowalikLending on Main Street: Challenges and Opportunities for Community Banks – Before, During and After the Financial CrisisJulapa Jagtiani and Catharine LemieuxSmall Bank Comparative Advantage in Alleviating Financial Constraints and Providing Liquidity Insurance over TimeAllen N. Berger, Christa H.S. Bouwman and Dasol KimHow does Farm Credit System Lending Affect Competition in Banking Markets?Eric Hogue, Chuck Morris and Jim WilkinsonReaction to Small Business and Farm Lending SessionSmall Business and Farm Lending- Moderated Question and Answer Session -

Presentation of Winning Video from CSBS' 2015 Inaugural Community Bank Case Study Competition

-

Reception and Dinner

-

Evening Keynote Address

- Thursday, October 1

-

Research Paper Session 2

Moderator: Julapa Jagtiani

Moderator: Julapa Jagtiani

Special Advisor, Supervision, Regulation and Credit Department, Federal Reserve Bank of Philadelphia

Community Bank Discussant: Charles "Chad" Paul, III

Community Bank Discussant: Charles "Chad" Paul, III

Director-member, North Carolina State Banking Commission; Managing Partner, Harbor Island Partners, LLC, Wilmington, N.C, North Carolina State Banking Commission; Harbor Island Partners, LLC, Wilmington, N.C.

Did the Financial Reforms of the Early 1990s Fail? A Comparison of Bank Failures and FDIC Losses in the 1986-1992 and 2007-13 Periods (PDF)Eliana Balla, Edward Simpson Prescott and John R. WalterFinancial Performance and Management Structure of Small, Closely Held BanksJohn M. Anderlik, Richard A. Brown, and Kathryn L. FritzdixonHow Vulnerable Are Agriculturally Concentrated Banks to a Fall in Agricultural Land Values?Ron Feldman and Jay SmithAn Historical Loss Approach to Community Bank Stress TestingTimothy J. YeagerReaction to Community Bank Performance session- Julapa JagtianiCommunity Bank Performance Moderated Question and Answer Session -

Break

-

Research Paper Session 3

The State and Fate of Community BankingRobert Greene and Marshall LuxAccounting for the Decline in the Number of Community Banks since the Great Recession; Explaining the Decline in the Number of Banks since the Great Recession (PDF)Roisin McCord and Edward Simpson PrescottThe Direct Costs of Bank Compliance around Crisis-Based Regulation for Small and Community BanksKen B. CyreePost-Crisis Residential Mortgage Lending by CommunityWilliam F. Bassett and John C. DriscollReaction to Community Banking: Pre- and Post-Crisis session Robin A. PragerCommunity Banking: Pre- and Post-Crisis Moderated Question and Answer Session -

Lunch

-

Afternoon Keynote Address

-

Break

-

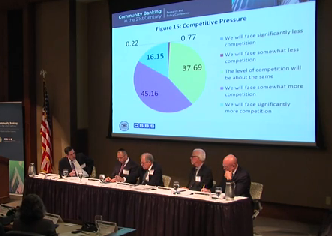

2015 National Survey of Community Banks: Presentation of Results

Presentation of Results2015 Community Banking in the 21st Century Research and Policy Conference Publication -

Panel Discussion: Community Banking in the 21st Century - 2015 National Survey of Community Banks and State Roundtables

Panelists Paul Sanford

Paul Sanford

Assistant Director for supervision examinations, Consumer Financial Protection Bureau (CFPB), Washington, D.C.

-

Conference Adjourn

Research Papers, Authors and Key Findings

Research Paper Session 1

Community Bank Discussant Presentation

The Changing Role of Small Banks in Small Business Lending

Authors: Lamont Black, Driehaus College of Business, DePaul University Chicago, Illinois; Michal Kowalik, Federal Reserve Bank of Boston

Abstract: This paper studies the effects of competition from large banks on small banks’ lending to small business borrowers. Small banks are better at monitoring their borrowers, but large banks have lower financing costs. This study looks at bank balance sheet data broken down by bank size. The study’s findings indicate that single-market banks increase their shares of small business loans in the intermediate size category ($250,000 to $1 million) following large bank entry into the market.

Small Business Lending Challenges and Opportunities for Community Banks

Authors: Catharine Lemieux, Federal Reserve Bank of Chicago; Julapa Jagtiani, Federal Reserve Bank of Philadelphia

Abstract: The ongoing evolution of the small business lending sector presents both challenges and opportunities to community banks. Many argue that the recent financial crisis and subsequent changes to the regulatory environment have resulted in declines in small business lending both directly and indirectly, by accelerating the effects of other contributing factors. Community banks face greater competition as large banks have increasingly leveraged technology to compete for smaller commercial borrowers. Competitive pressures on community banks are also rising as many borrowers become more comfortable turning to nonbank lenders. These alternative lenders have begun to introduce sophisticated technologies and new underwriting methods to issue small business loans quickly and electronically. Meanwhile, more established businesses are expecting more from small banks in terms of new products, technology and customer services. However, concurrent post-crisis regulations have made community banks less flexible, especially relative to unregulated nonbank lenders.

Despite these challenges, community banks are seeing new opportunities as well. Demand is higher for Small Business Administration loans, which are profitable products for many community banks. Growing interest in unconventional, higher-margin loan products may fit well with community banks. Historically, small banks have been strong in qualitative borrower analysis and relationship lending. There are recent examples of banks partnering with alternative lenders to purchase qualifying loans originated by online platforms.

Small Bank Comparative Advantage

Authors: Allen Berger, Darla Moore School of Business, University of South Carolina; Christa Bouwman, Texas A&M University; Dasol Kim,

Abstract: This paper uses novel survey data on U.S. small businesses ranging from 1993-2012 to evaluate whether small banks, compared to large banks, provided better financial support to small businesses. The analysis concludes that small banks have a stronger comparative advantage when local economic conditions are worse. It also finds that this advantage has not diminished over time.

During the recent financial crisis, both types of banks reduced lending to small businesses. However, following the Lehman Brother failure, small banks provided more support in regions dependent on asset-backed commercial paper markets. The paper asserts that small banks were able to achieve this by providing liquidity insurance to relationship borrowers. Large banks are more reliant on transactional lending technologies, like credit scoring models, which can be less effective during periods of economic stress.

Competition in Agricultural Lending Markets: The Effect of Including the Farm Credit System

Authors: Charles Morris, Federal Reserve Bank of Kansas City; James Wilkinson, Federal Reserve Bank of Kansas City; Eric Hogue, Federal Reserve Bank of Kansas City

Abstract: In recent years, bank consolidations have led to measurable increases in banking market concentration, according to traditional metrics. However, standard deposit-based measures for banking market concentration and competition fall short regarding capturing the impact of competitive pressures from non-bank institutions. In rural markets, agricultural lending is a principal business activity, and the Farm Credit System’s Agricultural Credit Associations (ACAs) play an important role.

This paper examines the lending structures and practices in rural banking markets, as well as the trends amongst traditional bank and ACA lending. Using this analysis, the paper puts forth a lending-based measure of banking market concentration that includes ACA activities. The final section calculates market shares of individual lenders and market concentration ratios with the new model and compares them to the deposit-based measurements.

Reaction to Small Business and Farm Lending Session

Small Business and Farm Lending- Moderated Question and Answer Session

Research Paper Session 2

Did the Financial Reforms of the Early 1990s Fail? A Comparison of Bank Failures and FDIC Losses in the 1986-92 and 2007-13 Periods

Authors: Eliana Balla, Federal Reserve Bank of Richmond; Edward Prescott, Federal Reserve Bank of Cleveland; John Walter, Federal Reserve Bank of Kansas City

Abstract: The banking problems in the late 1980s and early 1990s spurred two significant changes to banking supervision and regulation: the Basel 1 capital requirements and the prompt corrective actions (PCA) provisions of the FDIC Improvement Act (FDICIA). The PCA provisions, specifically, require regulators to shut down banks before book capital becomes negative.

To examine the impact of these reforms, this paper compares failures and FDIC losses on commercial banks in two different eras, the 1980-1990s, before the FDICIA and Basel 1 reforms, and then the recent financial crisis. The analysis uses a sample of community and mid-sized banks and shows that predictors of failure and high losses were matching across crises. The paper also finds that the failure rate in the recent period was driven more by severe economic conditions than by high concentrations in real estate lending.

While the PCA provisions and the increased capital requirements reduced the bank failure rate, they were less effective in mitigating FDIC losses. FDIC losses on commercial banks were 14 percent of failed bank assets in the first period, but rose to approximately 24 percent in the second period. The study found that neither variations in bank balance sheets, nor local economic conditions were able to explain variations in FDIC losses. However, “interest accrued, but not yet received”, a discretionary accounting variable, was predictive for both bank failure and higher FDIC losses.

Financial Performance and Management Structure of Small, Closely Held Banks

Authors: John Anderlik, Federal Deposit Insurance Corporation (FDIC); Richard Brown, Federal Deposit Insurance Corporation (FDIC); Kathryn Fritzdixon, Federal Deposit Insurance Corporation (FDIC)

Abstract: This paper examines the challenges and opportunities specific to closely held banks. It is based on a survey of bank examiners in three FDIC supervisory regions that is used to identify the ownership and management structure of over 1,400 institutions. Almost 75 percent of community banks in these regions can be regarded as closely held, typically on the basis of family or community ties. Closely held banks may face certain operational challenges in terms of raising external capital and recruiting future managers, especially in rural areas. At the same time, closely held banks may have certain operational advantages, including the ability to focus on long term goals and to minimize agency problems that may arise from the separation of ownership and operational control. The paper compares the performance of closely and widely held banks as identified in the survey and finds that closely held banks do not appear, on net, to have underperforming widely held banks in recent years. However, the results also point to the possibility that succession management may be a more difficult problem to them to resolve over the long term.

How Vulnerable Are Agriculturally Concentrated Banks to a Fall in Agricultural Land Values

Authors: Joseph "Jay" Smith, Federal Reserve Bank of Minneapolis; Ron Feldman, Federal Reserve Bank of Minneapolis

Abstract: Agricultural land values are currently at all-time highs, both in absolute terms and relative to the income they generate (e.g., price-to-rent ratio). This paper examines the determinants of performance of the agricultural sector and provides background on agricultural lending. Its focus is modeling the impact of a fall in land values on banks with large agricultural concentrations and exposure. Evidence indicates that the average agricultural bank would not suffer large loans losses. However, the subset of agricultural banks that are the most sensitive to land value declines would suffer substantial losses and reduced levels of capital.

An Historical Loss Approach to Community Bank Stress Testing

Author: Timothy Yeager, University of Arkansas

Abstract: This paper develops a stress testing model for community banks that uses an historical loss approach, subjecting banks to credit conditions from the 2008-2012 period. The model attempts to capture the resiliency of small banks to severe commercial real estate (CRE) downturns and/or recessions. The stress test utilizes the new loan categories that were added to the call reports in 2007.

The paper focuses its analysis on the performance of residential construction loans and owner-occupied CRE loans, which had perceived lower default risk ex-ante. In fact, default rates amongst these loan types were similar to rates for nonresidential and non-owner occupied loans during the sample period. Consequently, this provided fewer diversification benefits.

Reaction to Community Bank Performance session- Julapa Jagtiani

Community Bank Performance Moderated Question and Answer Session

Research Paper Session 3

The State and Fate of Community Banking

Authors: Marshall Lux, Harvard Kennedy School, Mossavar-Rahmani Center for Business and Government; Robert Greene, Harvard Kennedy School, Mossavar-Rahmani Center for Business and Government

Abstract: Community banks service a large number of key segments of the U.S. commercial bank lending market, including agriculture, real estate and small business loans. However, over the past 20 years, community banks’ market share of assets and lending has fallen from over 40 percent in 1994 to about 20 percent today. However, the passage of the Dodd-Frank Act seems to have accelerated this trend. Since its passage, around the second quarter of 2010, community banks’ share of U.S. commercial banking assets has fallen at a rate twice as quickly as compared to the previous four years. Community banks have also seen significant decreases in small business lending volume and incurred disproportionately large losses.

This paper aims to review the impact of regulation, consumer trends and other factors on community banks. It also examines the consequences of consolidation on U.S. lending markets and concludes with a discussion of policies to promote a more competitive and robust banking sector.

Accounting for the Decline in the Number of Community Banks since the Great Recession

Authors: Edward Prescott, Federal Reserve Bank of Cleveland; Roisin McCord, Federal Reserve Bank of Richmond

Abstract: Since the 2007-2009 financial crisis, there has been a significant change in the number of banks in the U.S. At the end of 2007, there were 6,153 commercial banks. By 2013, the number of banks had fallen to 5,317, a decrease of 13.6 percent. This article looks at the changes in the dynamics of entry and exit in the banking sector, as well as the fluctuations in market share of banks of differing sizes. According to the paper, measures of entrances by new banks have been inflated since the Great Recession because the majority of recent entrants have been spinoffs from larger holding companies and converted non-bank lenders. It examines the lack of de novo banks and posits two explanations for the dramatic decline in the influx of new banks since 2009: weak economic growth and restrictive banking regulations. The article concludes by discussing the implications that the current pace of decline of commercial banks could have if it continues.

The Direct Costs of Bank Compliance around Crisis-Based Regulation for Small and Community Banks

Author: Ken Cyree, University of Mississippi School of Business Administration; Director, Mississippi School of Banking

Abstract: This paper looks at the impact of regulatory policy changes and legislation from the past 25 years, the Dodd-Frank Act in particular, on compliance costs for community banks. The 2014 KPMG Community Banking Survey indicates that many bankers find the regulatory burden placed on community banks to be the largest constraint to growth.

This study looks at pre-tax return on investment and loans per employee as measures for banks’ performance and output. Salaries-to-assets, average pay, and technology and fixed assets are all used as measures for the changes in resource allocation and expenditure. The paper explores the reasons that changes in these variables following the Dodd-Frank Act deviate from patterns seen with several other major regulatory changes going back to 1991. Findings show that direct and indirect compliance costs have complex manifestations that go beyond hiring more people to perform additional regulatory and compliance tasks.

Post-Crisis Residential Mortgage Lending by Community

Authors: John Driscoll, Board of Governors of the Federal Reserve System; William Bassett, Board of Governors of the Federal Reserve System

Abstract: Since the recent financial crisis, policymakers have made several changes to the supervision and regulation of originations of mortgage loans with the intent of selling and securitizing them. Some banks and researchers have argued that these changes in the regulatory environment have restricted community bank activities in this market. This study looks at bank Call Reports to examine the profitability and participation of banks in mortgage sales and securitization. Analysis shows that community banks engaged in these activities have higher returns on assets and equity than larger banks. The paper argues that banks have not been, on net, deterred from engaging in these activities, have become a more important part of the market, and have profited from mortgage sales and securitization.

Reaction to Community Banking: Pre- and Post-Crisis session Robin A. Prager

Community Banking: Pre- and Post-Crisis Moderated Question and Answer Session

Speakers and Panelists

Eliana Balla is a lead financial economist in the Supervision, Regulation and Credit Department of the Federal Reserve Bank of Richmond, where she oversees a team of economists engaged in quantitative supervision. She has served both as an individual contributor and in a Federal Reserve System coordinating capacity on large-scale model development and validation projects as part of the Dodd-Frank Act stress testing program. Her regulatory work has also included monitoring and analysis of banking industry conditions, with a focus on community and regional banks. Balla’s research interests include bank performance and capital regulation, with recent publications on loan loss reserves and systemic risk. Prior to joining the Richmond Fed in 2005, Balla completed a master’s degree and a doctorate degree in economics from Washington University in St. Louis.

Eliana Balla is a lead financial economist in the Supervision, Regulation and Credit Department of the Federal Reserve Bank of Richmond, where she oversees a team of economists engaged in quantitative supervision. She has served both as an individual contributor and in a Federal Reserve System coordinating capacity on large-scale model development and validation projects as part of the Dodd-Frank Act stress testing program. Her regulatory work has also included monitoring and analysis of banking industry conditions, with a focus on community and regional banks. Balla’s research interests include bank performance and capital regulation, with recent publications on loan loss reserves and systemic risk. Prior to joining the Richmond Fed in 2005, Balla completed a master’s degree and a doctorate degree in economics from Washington University in St. Louis.

Eric S. Belsky has served as the director of the division of Consumer and Community Affairs at the Federal Reserve Board of Governors since August 2014. He oversees the Federal Reserve’s work in consumer-focused supervision, research, and policy analysis, with the aim of promoting a fair and transparent consumer financial services marketplace. Belsky has more than 20 years of experience in housing finance, economics and policy. Before joining the Federal Reserve Board, he served as managing director for the Joint Center for Housing Studies of Harvard University. Belsky has also held the positions of director of Housing Finance Research at Fannie Mae and as senior economist at the National Association of Home Builders. He has taught at both Harvard University and the University of Massachusetts at Amherst. Throughout his career, Belsky has lent his expertise to numerous organizations, including the Opportunity Finance Network, Fannie Mae’s Affordable Housing Advisory Council and Bank of America’s National Community Advisory Council. In 2001 and 2002, Belsky served as research director for the bipartisan Millennial Housing Commission established by the U.S. Congress. Throughout his career, Belsky has conducted research on a wide range of housing and urban topics for public and private sector organizations and clients. He has co-edited six books and authored numerous articles and book chapters, and has served on the editorial boards of the Journal of Housing Research and Housing Policy Debate.

Eric S. Belsky has served as the director of the division of Consumer and Community Affairs at the Federal Reserve Board of Governors since August 2014. He oversees the Federal Reserve’s work in consumer-focused supervision, research, and policy analysis, with the aim of promoting a fair and transparent consumer financial services marketplace. Belsky has more than 20 years of experience in housing finance, economics and policy. Before joining the Federal Reserve Board, he served as managing director for the Joint Center for Housing Studies of Harvard University. Belsky has also held the positions of director of Housing Finance Research at Fannie Mae and as senior economist at the National Association of Home Builders. He has taught at both Harvard University and the University of Massachusetts at Amherst. Throughout his career, Belsky has lent his expertise to numerous organizations, including the Opportunity Finance Network, Fannie Mae’s Affordable Housing Advisory Council and Bank of America’s National Community Advisory Council. In 2001 and 2002, Belsky served as research director for the bipartisan Millennial Housing Commission established by the U.S. Congress. Throughout his career, Belsky has conducted research on a wide range of housing and urban topics for public and private sector organizations and clients. He has co-edited six books and authored numerous articles and book chapters, and has served on the editorial boards of the Journal of Housing Research and Housing Policy Debate.

Allen N. Berger is the H. Montague Osteen, Jr., Professor in Banking and Finance and Ph.D. coordinator of the Finance Department, Darla Moore School of Business; Carolina Distinguished Professor, University of South Carolina; senior fellow, Wharton Financial Institutions Center; and fellow, European Banking Center. He also serves on the editorial boards of six professional finance journals. In addition, Berger is past editor of the Journal of Money, Credit, and Banking from 1994-2001 and has co-edited six special issues of various professional journals and the first and second editions of the Oxford Handbook of Banking, and will be co-editing the third edition, due out in 2020. His research covers a variety of topics related to financial institutions. He is co-author of Bank Liquidity Creation and Financial Crises (2016, Elsevier) and will be co-author of TARP and other Bank Bailouts and Bail-Ins around the World: Connecting Wall Street, Main Street, and the Financial System, due out in 2019. He has published more than 100 professional articles in refereed journals, including papers in top finance journals, Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Financial and Quantitative Analysis, Review of Finance, and Journal of Financial Intermediation; top economics journals, Journal of Political Economy, American Economic Review, Review of Economics and Statistics, and Journal of Monetary Economics; and other top professional business journals, Management Science and Journal of Business; and more than 30 other non-refereed publications. His research has been cited more than 50,000 times according to Google Scholar. Berger was named professor of the year for 2015-2016 by the Darla Moore School of Business Doctoral Students Association. He was also secretary/treasurer, Financial Intermediation Research Society from 2008-2016; and senior economist from 1989 to 2008 and economist from 1982-1989 at the Board of Governors of the Federal Reserve System. He received a Ph.D. in economics from the University of California at Berkeley in 1983, and a bachelor’s degree in economics from Northwestern University in 1976.

Allen N. Berger is the H. Montague Osteen, Jr., Professor in Banking and Finance and Ph.D. coordinator of the Finance Department, Darla Moore School of Business; Carolina Distinguished Professor, University of South Carolina; senior fellow, Wharton Financial Institutions Center; and fellow, European Banking Center. He also serves on the editorial boards of six professional finance journals. In addition, Berger is past editor of the Journal of Money, Credit, and Banking from 1994-2001 and has co-edited six special issues of various professional journals and the first and second editions of the Oxford Handbook of Banking, and will be co-editing the third edition, due out in 2020. His research covers a variety of topics related to financial institutions. He is co-author of Bank Liquidity Creation and Financial Crises (2016, Elsevier) and will be co-author of TARP and other Bank Bailouts and Bail-Ins around the World: Connecting Wall Street, Main Street, and the Financial System, due out in 2019. He has published more than 100 professional articles in refereed journals, including papers in top finance journals, Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Financial and Quantitative Analysis, Review of Finance, and Journal of Financial Intermediation; top economics journals, Journal of Political Economy, American Economic Review, Review of Economics and Statistics, and Journal of Monetary Economics; and other top professional business journals, Management Science and Journal of Business; and more than 30 other non-refereed publications. His research has been cited more than 50,000 times according to Google Scholar. Berger was named professor of the year for 2015-2016 by the Darla Moore School of Business Doctoral Students Association. He was also secretary/treasurer, Financial Intermediation Research Society from 2008-2016; and senior economist from 1989 to 2008 and economist from 1982-1989 at the Board of Governors of the Federal Reserve System. He received a Ph.D. in economics from the University of California at Berkeley in 1983, and a bachelor’s degree in economics from Northwestern University in 1976.

Lamont Black is an associate professor of finance in the Driehaus College of Business at DePaul University, Chicago, Illinois. Black is also the academic director of DePaul’s John L. Keeley Center for Financial Services. Prior to joining the faculty of DePaul, Black was an economist at the Federal Reserve Board of Governors in Washington, D.C. His main research interests are in the areas of banking, corporate finance and macroeconomics. His research has been published in numerous journals, including the Review of Financial Studies; the Journal of Money, Credit and Banking; and the Journal of Banking and Finance. Black teaches money, banking, and capital markets to undergraduate and graduate students. He received a Ph.D. in Finance, as well as his Ph.D. in Economics, from the Kelley School of Business at Indiana University. He received his bachelor's degree in Modern Thought and Literature from Stanford University.

Lamont Black is an associate professor of finance in the Driehaus College of Business at DePaul University, Chicago, Illinois. Black is also the academic director of DePaul’s John L. Keeley Center for Financial Services. Prior to joining the faculty of DePaul, Black was an economist at the Federal Reserve Board of Governors in Washington, D.C. His main research interests are in the areas of banking, corporate finance and macroeconomics. His research has been published in numerous journals, including the Review of Financial Studies; the Journal of Money, Credit and Banking; and the Journal of Banking and Finance. Black teaches money, banking, and capital markets to undergraduate and graduate students. He received a Ph.D. in Finance, as well as his Ph.D. in Economics, from the Kelley School of Business at Indiana University. He received his bachelor's degree in Modern Thought and Literature from Stanford University.

Lael Brainard took office as a member of the Board of Governors of the Federal Reserve System on June 16, 2014, to fill an unexpired term ending January 31, 2026. Prior to her appointment to the Board, Brainard served as Undersecretary of the U.S. Department of Treasury from 2010 to 2013, and as Counselor to the Secretary of the Treasury in 2009. During this time, she was the U.S. Representative to the G-20 Finance Deputies and G-7 Deputies, and served as a member of the Financial Stability Board. She received the Alexander Hamilton Award for her service. From 2001 to 2008, Brainard was vice president and founding director of the Global Economy and Development Program at the Brookings Institution, where she also held the Bernard L. Schwartz Chair and built a new research program to address global economic challenges. Brainard served as the Deputy National Economic Adviser and Deputy Assistant to President Clinton and served as President Clinton's personal representative to the G-7/G-8. From 1990 to 1996, Brainard was an assistant and associate professor of applied economics at the Massachusetts Institute of Technology's Sloan School of Management. She has published numerous articles on economic topics and is the editor or co-editor of several books. Previously, Brainard worked in management consulting at McKinsey & Company. She received a Bachelor of Arts with university honors from Wesleyan University in 1983. She received a Master of Science degree and a Ph.D. in economics in 1989 from Harvard University, where she was awarded a National Science Foundation Fellowship. She is also the recipient of a White House Fellowship.

Lael Brainard took office as a member of the Board of Governors of the Federal Reserve System on June 16, 2014, to fill an unexpired term ending January 31, 2026. Prior to her appointment to the Board, Brainard served as Undersecretary of the U.S. Department of Treasury from 2010 to 2013, and as Counselor to the Secretary of the Treasury in 2009. During this time, she was the U.S. Representative to the G-20 Finance Deputies and G-7 Deputies, and served as a member of the Financial Stability Board. She received the Alexander Hamilton Award for her service. From 2001 to 2008, Brainard was vice president and founding director of the Global Economy and Development Program at the Brookings Institution, where she also held the Bernard L. Schwartz Chair and built a new research program to address global economic challenges. Brainard served as the Deputy National Economic Adviser and Deputy Assistant to President Clinton and served as President Clinton's personal representative to the G-7/G-8. From 1990 to 1996, Brainard was an assistant and associate professor of applied economics at the Massachusetts Institute of Technology's Sloan School of Management. She has published numerous articles on economic topics and is the editor or co-editor of several books. Previously, Brainard worked in management consulting at McKinsey & Company. She received a Bachelor of Arts with university honors from Wesleyan University in 1983. She received a Master of Science degree and a Ph.D. in economics in 1989 from Harvard University, where she was awarded a National Science Foundation Fellowship. She is also the recipient of a White House Fellowship.

Steve Brown has served as president and CEO of Pacific Coast Bankers’ Bancshares and subsidiaries since July 2007. Prior to that, Brown co-founded PCBB Capital Markets and was also a co-founder of a web-based capital markets trading platform that connected the world’s largest providers of cash and investment products with the nation’s community banks. He was also managing director at Bank of America Securities, in charge of fixed income and other product sales to community banks nationwide, and a director at ICAP, the world’s largest interdealer wholesale broker of Federal funds, interest rate hedging, foreign exchange and other capital markets products. Brown was also an assistant treasurer with a $2 billion community bank, with expertise in mergers and acquisitions, finance, investment and cash management. He holds FINRA Series 7, 8, 24 and 63 licenses and is the author of the popular Banc Investment Daily newsletter. Brown is frequently quoted in national media on banking trends and issues.

Steve Brown has served as president and CEO of Pacific Coast Bankers’ Bancshares and subsidiaries since July 2007. Prior to that, Brown co-founded PCBB Capital Markets and was also a co-founder of a web-based capital markets trading platform that connected the world’s largest providers of cash and investment products with the nation’s community banks. He was also managing director at Bank of America Securities, in charge of fixed income and other product sales to community banks nationwide, and a director at ICAP, the world’s largest interdealer wholesale broker of Federal funds, interest rate hedging, foreign exchange and other capital markets products. Brown was also an assistant treasurer with a $2 billion community bank, with expertise in mergers and acquisitions, finance, investment and cash management. He holds FINRA Series 7, 8, 24 and 63 licenses and is the author of the popular Banc Investment Daily newsletter. Brown is frequently quoted in national media on banking trends and issues.

James Bullard is the president and CEO of the Federal Reserve Bank of St. Louis. In that role, he is a participant on the Federal Reserve’s Federal Open Market Committee (FOMC), which meets regularly to set the direction of U.S. monetary policy. He also oversees the Federal Reserve’s Eighth District, including activities at the St. Louis headquarters and its branches in Little Rock, Arkansas, Louisville, Kentucky, and Memphis, Tennessee. A noted economist and policymaker, Bullard makes Fed transparency and dialogue a priority on the international and national stage as well as on Main Street. He serves on the board of directors of the St. Louis Regional Chamber and the board of directors of Concordance Academy of Leadership, and he is a past board chair of the United Way U.S.A. Bullard is co-editor of the Journal of Economic Dynamics and Control, and a member of the Central Bank Research Association’s senior council. He is an honorary professor of economics at Washington University in St. Louis, where he also sits on the advisory council of the economics department and the advisory board of the Center for Dynamic Economics. A native of Forest Lake, Minnesota, Bullard received his doctorate in economics from Indiana University in Bloomington.

Megan F. Clubb is the chief executive officer of Baker Boyer National Bank headquartered in Walla Walla, Wash. Baker Boyer is the oldest independently owned community bank in the Pacific Northwest. Its team of advisors have diverse expertise and are focused on one goal: to help local families manage assets to build local legacies. Baker Boyer has been a top performing bank over the years, receiving recognition in many areas. It has been ranked on American Banker’s list of the “Top 200 Community Banks” consecutively since 2008. Seattle Business magazine has ranked it on the list of “Best Places to Work in Washington” consecutively since 2004. Additionally, Baker Boyer was recognized by Seattle Business as winner of the Best Family Business Award in 2012. Clubb has brought about a great deal of change in a family-owned community bank at a time when the overall industry was challenged. She has increased the bank’s profitability, grown its customer base and opened new offices during a very tough economic period. She currently serves as a director for the Federal Reserve Bank of San Francisco. She also serves as the vice president of the Foundation Board for the William D. Ruckelshaus Center at Washington State University and is on the board of trustees for Whitman College. Prior to joining Baker Boyer, Clubb worked for Marakon Associates, an international consulting firm that was a spin-off of Wells Fargo’s Corporate Finance group. Clubb holds a bachelor’s degree in economics from Whitman College and and a master’s degree in management from the Sloan School of Management at the Massachusetts Institute of Technology.

Megan F. Clubb is the chief executive officer of Baker Boyer National Bank headquartered in Walla Walla, Wash. Baker Boyer is the oldest independently owned community bank in the Pacific Northwest. Its team of advisors have diverse expertise and are focused on one goal: to help local families manage assets to build local legacies. Baker Boyer has been a top performing bank over the years, receiving recognition in many areas. It has been ranked on American Banker’s list of the “Top 200 Community Banks” consecutively since 2008. Seattle Business magazine has ranked it on the list of “Best Places to Work in Washington” consecutively since 2004. Additionally, Baker Boyer was recognized by Seattle Business as winner of the Best Family Business Award in 2012. Clubb has brought about a great deal of change in a family-owned community bank at a time when the overall industry was challenged. She has increased the bank’s profitability, grown its customer base and opened new offices during a very tough economic period. She currently serves as a director for the Federal Reserve Bank of San Francisco. She also serves as the vice president of the Foundation Board for the William D. Ruckelshaus Center at Washington State University and is on the board of trustees for Whitman College. Prior to joining Baker Boyer, Clubb worked for Marakon Associates, an international consulting firm that was a spin-off of Wells Fargo’s Corporate Finance group. Clubb holds a bachelor’s degree in economics from Whitman College and and a master’s degree in management from the Sloan School of Management at the Massachusetts Institute of Technology.

Charles G. Cooper was appointed Texas Banking Commissioner by the Texas Finance Commission on December 1, 2008. His banking career spans over 45 years and includes senior level positions in both the public and private sectors. As Texas Banking Commissioner, his responsibilities include the chartering, regulation, supervision and examination of 264 Texas state-chartered banks with aggregate assets of approximately $241.9 billion. His duties also encompass trust companies, foreign bank agencies and branches, non-bank supervision programs that include the licensing, regulation and supervision of funeral contract providers, perpetual care cemeteries, and money service businesses, as well as the registration of private child support enforcement agencies. He also serves as chairman-elect of the Conference of State Bank Supervisors. A native Texan, Cooper holds a Bachelor of Business Administration degree in finance and economics from Baylor University and is a graduate of the Southwestern Graduate School of Banking at Southern Methodist University. He also holds an advanced peace officer certification with the Texas Commission on Law Enforcement. He has been on the board of the Fort Worth Stock Show Syndicate since 1990 and has been a member of the State Fair of Texas Youth Livestock Auction Committee since 2005.

Charles G. Cooper was appointed Texas Banking Commissioner by the Texas Finance Commission on December 1, 2008. His banking career spans over 45 years and includes senior level positions in both the public and private sectors. As Texas Banking Commissioner, his responsibilities include the chartering, regulation, supervision and examination of 264 Texas state-chartered banks with aggregate assets of approximately $241.9 billion. His duties also encompass trust companies, foreign bank agencies and branches, non-bank supervision programs that include the licensing, regulation and supervision of funeral contract providers, perpetual care cemeteries, and money service businesses, as well as the registration of private child support enforcement agencies. He also serves as chairman-elect of the Conference of State Bank Supervisors. A native Texan, Cooper holds a Bachelor of Business Administration degree in finance and economics from Baylor University and is a graduate of the Southwestern Graduate School of Banking at Southern Methodist University. He also holds an advanced peace officer certification with the Texas Commission on Law Enforcement. He has been on the board of the Fort Worth Stock Show Syndicate since 1990 and has been a member of the State Fair of Texas Youth Livestock Auction Committee since 2005.

David J. Cotney has served as the Massachusetts Commissioner of Banks since November 2010. He oversees the supervision of nearly 200 banks and credit unions with total combined assets in excess of $400 billion. His office is also responsible for the licensing and supervision of nearly 8,500 non-depository licensees including mortgage lenders, mortgage brokers, mortgage loan originators, consumer finance companies, money services businesses, debt collectors, and loan servicers. Cotney began his career at the Division of Banks 25 years ago as a bank examiner. Cotney is an active contributor to consumer protection efforts both in Massachusetts and nationally. In 2015, Mr. Cotney was elected chairman of the Board of Directors of the Conference of State Bank Supervisors (CSBS). He serves as a member of the board of the CSBS Education Foundation and of the Board of Managers of the State Regulatory Registry (SRR), where he previously served as chairman. From 2013 to 2015, Cotney served as chairman of the State Liaison Committee (SLC) of the Federal Financial Institutions Examination Council (FFIEC). Additionally, from 2014 to 2015, Cotney was appointed to serve as chairman of the CSBS Emerging Payments Task Force. He holds a Bachelor of Arts degree from Tufts University, an MBA from Boston University, and a Master in Public Administration degree from Harvard University’s John F. Kennedy School of Government.

David J. Cotney has served as the Massachusetts Commissioner of Banks since November 2010. He oversees the supervision of nearly 200 banks and credit unions with total combined assets in excess of $400 billion. His office is also responsible for the licensing and supervision of nearly 8,500 non-depository licensees including mortgage lenders, mortgage brokers, mortgage loan originators, consumer finance companies, money services businesses, debt collectors, and loan servicers. Cotney began his career at the Division of Banks 25 years ago as a bank examiner. Cotney is an active contributor to consumer protection efforts both in Massachusetts and nationally. In 2015, Mr. Cotney was elected chairman of the Board of Directors of the Conference of State Bank Supervisors (CSBS). He serves as a member of the board of the CSBS Education Foundation and of the Board of Managers of the State Regulatory Registry (SRR), where he previously served as chairman. From 2013 to 2015, Cotney served as chairman of the State Liaison Committee (SLC) of the Federal Financial Institutions Examination Council (FFIEC). Additionally, from 2014 to 2015, Cotney was appointed to serve as chairman of the CSBS Emerging Payments Task Force. He holds a Bachelor of Arts degree from Tufts University, an MBA from Boston University, and a Master in Public Administration degree from Harvard University’s John F. Kennedy School of Government.

Ken B. Cyree is the dean and the Frank R. Day/Mississippi Bankers Association Chair of Banking at the University of Mississippi School of Business Administration, where he is also a professor of finance. Cyree received his doctorate and his Master of Business Administration from the University of Tennessee. He is the director of the Mississippi School of Banking and a faculty member at the Graduate School of Banking at Louisiana State University. Cyree’s research interests are in banking, financial markets, interest rates and regulation. He has papers published in the Journal of Business, Financial Management, the Journal of Banking and Finance, the Journal of Financial Research, the Journal of Financial Services Research, the Journal of Financial Markets, the Financial Review, along with several other academic journals. In addition, Cyree has served on the editorial board of the Journal of Business Research and is currently an associate editor at the Journal of Financial Research. He is past president of the Southern Finance Association and served on the nominating committee for the Eastern Finance Association. Cyree was named the University of Mississippi School of Business Administration’s “Outstanding Teacher of the Year” in 2007 and “Outstanding Senior Researcher” in 2014.

Ken B. Cyree is the dean and the Frank R. Day/Mississippi Bankers Association Chair of Banking at the University of Mississippi School of Business Administration, where he is also a professor of finance. Cyree received his doctorate and his Master of Business Administration from the University of Tennessee. He is the director of the Mississippi School of Banking and a faculty member at the Graduate School of Banking at Louisiana State University. Cyree’s research interests are in banking, financial markets, interest rates and regulation. He has papers published in the Journal of Business, Financial Management, the Journal of Banking and Finance, the Journal of Financial Research, the Journal of Financial Services Research, the Journal of Financial Markets, the Financial Review, along with several other academic journals. In addition, Cyree has served on the editorial board of the Journal of Business Research and is currently an associate editor at the Journal of Financial Research. He is past president of the Southern Finance Association and served on the nominating committee for the Eastern Finance Association. Cyree was named the University of Mississippi School of Business Administration’s “Outstanding Teacher of the Year” in 2007 and “Outstanding Senior Researcher” in 2014.

Ron J. Feldman is an executive vice president and senior policy advisor at the Federal Reserve Bank of Minneapolis. He is the senior officer for Supervision, Regulation and Credit, where he oversees the consumer and safety and soundness supervision of about 75 state member banks and about 500 bank holding companies. He is also responsible for the Bank’s lending to Ninth District depository institutions and managing the resulting credit risk. Feldman holds a variety of Federal Reserve System supervisory leadership roles. For example, he co-leads the group overseeing the System’s supervision of banks that have under $10 billion in assets. He also manages the System’s validation of Federal Reserve stress testing models. Feldman is also a primary adviser on monetary policy to the Bank president. He helps oversee the Federal Reserve’s monitoring of financial system stability and the identification of risks to stability. Feldman joined the bank in 1995 in the Supervision department. He became an officer of the bank in 1999, a managing officer in 2004, senior vice president in 2008 and executive vice president in 2013. In addition to assuming increasing responsibilities in the supervisory arena, he previously ran the Financial Services Support Office, which assists in the oversight of the Federal Reserve’s financial services. Feldman has published research on a wide array of banking and financial topics. He is the co-author of “Too Big to Fail: The Hazards of Bank Bailouts,” published by the Brookings Institution (2004). He has a Bachelor of Arts degree from the University of Wisconsin and a Master of Public Administration degree from Syracuse University.

Ron J. Feldman is an executive vice president and senior policy advisor at the Federal Reserve Bank of Minneapolis. He is the senior officer for Supervision, Regulation and Credit, where he oversees the consumer and safety and soundness supervision of about 75 state member banks and about 500 bank holding companies. He is also responsible for the Bank’s lending to Ninth District depository institutions and managing the resulting credit risk. Feldman holds a variety of Federal Reserve System supervisory leadership roles. For example, he co-leads the group overseeing the System’s supervision of banks that have under $10 billion in assets. He also manages the System’s validation of Federal Reserve stress testing models. Feldman is also a primary adviser on monetary policy to the Bank president. He helps oversee the Federal Reserve’s monitoring of financial system stability and the identification of risks to stability. Feldman joined the bank in 1995 in the Supervision department. He became an officer of the bank in 1999, a managing officer in 2004, senior vice president in 2008 and executive vice president in 2013. In addition to assuming increasing responsibilities in the supervisory arena, he previously ran the Financial Services Support Office, which assists in the oversight of the Federal Reserve’s financial services. Feldman has published research on a wide array of banking and financial topics. He is the co-author of “Too Big to Fail: The Hazards of Bank Bailouts,” published by the Brookings Institution (2004). He has a Bachelor of Arts degree from the University of Wisconsin and a Master of Public Administration degree from Syracuse University.

Gilles Gade is a founder of Cross River Bank (CRB) and has served as its chairman, president and CEO since its inception in 2008. He is steering CRB as an innovation-driven, state-chartered bank and as a provider of fully compliant financial solutions to the marketplace lending and payments sectors. Gade possesses more than 20 years of experience in investment banking and venture capital, including serving as co-founder and managing director of Chela Technology Partners and Chela Internet Ventures, a boutique investment bank and venture fund focusing on emerging technologies and telecommunications. He was also a technology investment banker at Barclays Capital and an investment banker with the Financial Institutions Group at Bear Stearns. Gade started his career in 1990 at Citicorp Venture Capital. He graduated from the MBA Institute IMIP (Groupe IPESUP) in Paris, France, with an MS in International Management.

Gilles Gade is a founder of Cross River Bank (CRB) and has served as its chairman, president and CEO since its inception in 2008. He is steering CRB as an innovation-driven, state-chartered bank and as a provider of fully compliant financial solutions to the marketplace lending and payments sectors. Gade possesses more than 20 years of experience in investment banking and venture capital, including serving as co-founder and managing director of Chela Technology Partners and Chela Internet Ventures, a boutique investment bank and venture fund focusing on emerging technologies and telecommunications. He was also a technology investment banker at Barclays Capital and an investment banker with the Financial Institutions Group at Bear Stearns. Gade started his career in 1990 at Citicorp Venture Capital. He graduated from the MBA Institute IMIP (Groupe IPESUP) in Paris, France, with an MS in International Management.

Julapa Jagtiani joined the Federal Reserve Bank of Philadelphia as a special advisor in the Supervision, Regulation and Credit Department in 2008. In this role, she has conducted research and participated in or led several supervisory policy and implementation projects, including Comprehensive Capital Analysis and Review (CCAR) stress testing, recovery and resolution plans, and Basel II qualification reviews. She is also a fellow member of the Wharton Financial Institutions Center. Previously, Jagtiani was a senior economist at the Federal Reserve Banks of Kansas City and Chicago. Before joining the Federal Reserve System in 1998, she was an associate professor of finance at Baruch College and an assistant professor of finance at Syracuse University. Her research areas include banking policy-related issues, such as too big to fail, systemic risk and financial stability, Basel II capital regulations, mergers and acquisitions, equity and bond markets and mortgages and home equity issues. She received a doctorate in finance and a master's degree in business administration from New York University's Stern School of Business. She was a Rockefeller Foundation Fellowship recipient.

Julapa Jagtiani joined the Federal Reserve Bank of Philadelphia as a special advisor in the Supervision, Regulation and Credit Department in 2008. In this role, she has conducted research and participated in or led several supervisory policy and implementation projects, including Comprehensive Capital Analysis and Review (CCAR) stress testing, recovery and resolution plans, and Basel II qualification reviews. She is also a fellow member of the Wharton Financial Institutions Center. Previously, Jagtiani was a senior economist at the Federal Reserve Banks of Kansas City and Chicago. Before joining the Federal Reserve System in 1998, she was an associate professor of finance at Baruch College and an assistant professor of finance at Syracuse University. Her research areas include banking policy-related issues, such as too big to fail, systemic risk and financial stability, Basel II capital regulations, mergers and acquisitions, equity and bond markets and mortgages and home equity issues. She received a doctorate in finance and a master's degree in business administration from New York University's Stern School of Business. She was a Rockefeller Foundation Fellowship recipient.

Catharine Lemieux is executive vice president in charge of supervision and regulation at the Federal Reserve Bank of Chicago. She directs the supervision and regulation of more than 800 banking organizations, including bank holding companies, state-chartered member banks, bank and savings and loan holding companies, financial holding companies and U.S. foreign bank branches within the Seventh Federal Reserve District. Additionally, she co-chairs the Supervision Performance and Planning Committee. Lemieux began her career with the Federal Reserve System at the Kansas City Fed in 1990. She joined the Chicago Fed as a senior examiner, and has assumed a number of management positions of increasing responsibility within the department. She has more than 30 years of experience in the industry, serving as a lender, professor, policy analyst and bank regulator. She holds a Ph.D. from Texas A&M University.

Marshall Lux is a senior fellow with the Mossavar-Rahmani Center for Business and Government at Harvard Univeristy’s John F. Kennedy School of Government, where he researches and teaches the Dodd-Frank Act, and is a senior advisor with the Boston Consulting Group. He has been an adjunct professor at the Leonard N. Stern School of Business at New York University and will be a visiting lecturer at the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School at Princeton University. Lux has served as a financial services and private equity consultant across all industries for nearly 30 years. He was with McKinsey for 23 years, serving as a director and senior partner. Most recently, he was a senior partner and managing director with the Boston Consulting Group, serving as the head of its North American private equity practice, which he helped build. From 2008-2009, he was chief risk officer for JPMorgan Chase’s consumer products division. During the financial crisis, he reported to the bank’s board and regulators and managed mortgages, credit cards, auto and student loans on a daily basis. Lux is a member of the Council on Foreign Relations and is active in the Brookings Institute. He serves on a number of private equity boards that cover a full range of financial services and non-financial services industries and has a long history of not-for-profit work. He is a member of the Chairman’s Council of the New York Historical Society. He is currently on the board for Reading is Fundamental (RIF) organization and has served on boards such as the Harlem Children’s Zone. Lux did extensive work post 9/11 for New York City. Lux graduated summa cum laude from Princeton University’s Woodrow Wilson School of Public and International Affairs, where he received his bachelor’s degree. He received his MBA from the Harvard Business School, where he was a Ford Scholar and a Baker Scholar. He was one of three to receive the Loeb Rhoades Award for excellence in finance.

Marshall Lux is a senior fellow with the Mossavar-Rahmani Center for Business and Government at Harvard Univeristy’s John F. Kennedy School of Government, where he researches and teaches the Dodd-Frank Act, and is a senior advisor with the Boston Consulting Group. He has been an adjunct professor at the Leonard N. Stern School of Business at New York University and will be a visiting lecturer at the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School at Princeton University. Lux has served as a financial services and private equity consultant across all industries for nearly 30 years. He was with McKinsey for 23 years, serving as a director and senior partner. Most recently, he was a senior partner and managing director with the Boston Consulting Group, serving as the head of its North American private equity practice, which he helped build. From 2008-2009, he was chief risk officer for JPMorgan Chase’s consumer products division. During the financial crisis, he reported to the bank’s board and regulators and managed mortgages, credit cards, auto and student loans on a daily basis. Lux is a member of the Council on Foreign Relations and is active in the Brookings Institute. He serves on a number of private equity boards that cover a full range of financial services and non-financial services industries and has a long history of not-for-profit work. He is a member of the Chairman’s Council of the New York Historical Society. He is currently on the board for Reading is Fundamental (RIF) organization and has served on boards such as the Harlem Children’s Zone. Lux did extensive work post 9/11 for New York City. Lux graduated summa cum laude from Princeton University’s Woodrow Wilson School of Public and International Affairs, where he received his bachelor’s degree. He received his MBA from the Harvard Business School, where he was a Ford Scholar and a Baker Scholar. He was one of three to receive the Loeb Rhoades Award for excellence in finance.

Andrew P. Meyer is a senior economist in the Community Bank Research and Outreach office of the Federal Reserve Bank of St. Louis. He received a doctorate in economics from Washington University in St. Louis and has worked at the Federal Reserve since 1994. In addition to his research on community banking issues, Meyer conducts statistical analysis of the downgrade and failure risk of commercial banks. He also serves on a committee to improve the Federal Reserve's off-site bank surveillance program and has taught regularly in examiner training schools.

Andrew P. Meyer is a senior economist in the Community Bank Research and Outreach office of the Federal Reserve Bank of St. Louis. He received a doctorate in economics from Washington University in St. Louis and has worked at the Federal Reserve since 1994. In addition to his research on community banking issues, Meyer conducts statistical analysis of the downgrade and failure risk of commercial banks. He also serves on a committee to improve the Federal Reserve's off-site bank surveillance program and has taught regularly in examiner training schools.

Richard H. Neiman serves as head of regulatory and government affairs for Lending Club, the world’s largest credit marketplace for connecting borrowers and investors. Neiman joined Lending Club full time in October 2014 after having served two years on its advisory panel. Previously, he served as vice chairman of the global financial services regulatory practice at PricewaterhouseCoopers. Neiman has more than 30 years of experience in the financial industry, having served in a range of executive, regulatory and legal roles during his career. Prior to joining PwC in June 2011, he served from March 2007 to May 2011 as New York State’s Superintendent of Banks, where he was responsible for the supervision of all state-chartered depository institutions, including the majority of foreign bank branches and agencies in the United States. While serving as superintendent, he was also appointed by the U.S. Congress to serve on the five-member Congressional Oversight Panel that was created to oversee the implementation of the Emergency Economic Stabilization Act, which included the Troubled Asset Relief Program (TARP). Earlier in his career, Neiman served as executive vice president and general counsel of TD Waterhouse Securities (now TD Ameritrade). He also served as general counsel of the Global Equities Division of Citibank, and as a director in the regulator advisory practice of what was then Price Waterhouse LLP. Neiman began his career with the Office of the Comptroller of the Currency in Washington, D.C., serving initially as staff attorney and then as special assistant to the chief counsel. He also serves as an adviser to the Bipartisan Policy Center’s Regulatory Reform Initiative and has co-chaired its regulatory architecture task force. Neiman serves on the board of the Harlem Educational Activities Fund (HEAF), a mentoring and college preparatory nonprofit, and on the board of the Henry Street Settlement, one of New York’s oldest social services organizations.

Richard H. Neiman serves as head of regulatory and government affairs for Lending Club, the world’s largest credit marketplace for connecting borrowers and investors. Neiman joined Lending Club full time in October 2014 after having served two years on its advisory panel. Previously, he served as vice chairman of the global financial services regulatory practice at PricewaterhouseCoopers. Neiman has more than 30 years of experience in the financial industry, having served in a range of executive, regulatory and legal roles during his career. Prior to joining PwC in June 2011, he served from March 2007 to May 2011 as New York State’s Superintendent of Banks, where he was responsible for the supervision of all state-chartered depository institutions, including the majority of foreign bank branches and agencies in the United States. While serving as superintendent, he was also appointed by the U.S. Congress to serve on the five-member Congressional Oversight Panel that was created to oversee the implementation of the Emergency Economic Stabilization Act, which included the Troubled Asset Relief Program (TARP). Earlier in his career, Neiman served as executive vice president and general counsel of TD Waterhouse Securities (now TD Ameritrade). He also served as general counsel of the Global Equities Division of Citibank, and as a director in the regulator advisory practice of what was then Price Waterhouse LLP. Neiman began his career with the Office of the Comptroller of the Currency in Washington, D.C., serving initially as staff attorney and then as special assistant to the chief counsel. He also serves as an adviser to the Bipartisan Policy Center’s Regulatory Reform Initiative and has co-chaired its regulatory architecture task force. Neiman serves on the board of the Harlem Educational Activities Fund (HEAF), a mentoring and college preparatory nonprofit, and on the board of the Henry Street Settlement, one of New York’s oldest social services organizations.

Charles (Chad) A. Paul, III is a director-member on the North Carolina State Banking Commission. In this role, he serves on the commission as a practical banker appointed by North Carolina Gov. Pat McCrory, and he also serves as chairperson of the commission’s strategic planning committee. Paul is president and chief executive officer of Bald Head Island Limited LLC, the principal owner-operator-developer of Bald Head Island, N.C. Paul is also a managing partner of Harbor Island Partners LLC, a private equity firm headquartered in Wilmington, N.C. He began his career working in investment banking, specializing in financial institutions and distressed securities. Prior to forming Harbor Island Partners, Paul was employed by Arnolt Partners LLC, Salomon Brothers Inc. and JPMorgan Chase. He was a founder and principal shareholder of four North Carolina-chartered de novo banks and has served on the board of directors of Crescent Financial Bancshares Inc. and VantageSouth Bancshares Inc. He has served as chairperson of audit and asset-liability committees and as a member of executive and loan committees during his banking director tenures. Paul received a master’s in business administration from Harvard University and a Bachelor of Arts degree with honors in economics from the College of The Holy Cross. His economics honor’s thesis, “The Deregulation Debate - The Repeal of the Glass-Steagall Act,” received the Cummings Gold Medal Award for the finest research paper submitted during the 1989 academic year.

Charles (Chad) A. Paul, III is a director-member on the North Carolina State Banking Commission. In this role, he serves on the commission as a practical banker appointed by North Carolina Gov. Pat McCrory, and he also serves as chairperson of the commission’s strategic planning committee. Paul is president and chief executive officer of Bald Head Island Limited LLC, the principal owner-operator-developer of Bald Head Island, N.C. Paul is also a managing partner of Harbor Island Partners LLC, a private equity firm headquartered in Wilmington, N.C. He began his career working in investment banking, specializing in financial institutions and distressed securities. Prior to forming Harbor Island Partners, Paul was employed by Arnolt Partners LLC, Salomon Brothers Inc. and JPMorgan Chase. He was a founder and principal shareholder of four North Carolina-chartered de novo banks and has served on the board of directors of Crescent Financial Bancshares Inc. and VantageSouth Bancshares Inc. He has served as chairperson of audit and asset-liability committees and as a member of executive and loan committees during his banking director tenures. Paul received a master’s in business administration from Harvard University and a Bachelor of Arts degree with honors in economics from the College of The Holy Cross. His economics honor’s thesis, “The Deregulation Debate - The Repeal of the Glass-Steagall Act,” received the Cummings Gold Medal Award for the finest research paper submitted during the 1989 academic year.

Robin A. Prager is a senior adviser in the Division of Research and Statistics at the Board of Governors of the Federal Reserve System. She joined the Board staff in 1994 as an economist in the Financial Structure Section, and served as chief of the Financial Structure Section from 2000 to 2007. Throughout her tenure at the Board, Prager has been involved in conducting economic analysis of issues relating to the structure and performance of the financial services sector, with an emphasis on banking. Recently, much of her attention has been devoted to issues surrounding the availability of credit to small businesses and the role of community banks in the U.S. financial system. Prager received a bachelor's degree in economics from Harvard University and a doctorate in economics from the Massachusetts Institute of Technology. Prior to joining the staff of the Federal Reserve Board, Prager served on the faculty of the Owen Graduate School of Management at Vanderbilt University. She has also been a visiting faculty member at Boston University's School of Management and MIT's Sloan School of Management, and a visiting senior policy scholar at Georgetown University's Center for Business and Public Policy. She currently serves on the board of the Industrial Organization Society and on the editorial boards of the Review of Industrial Organization and Journal of Regulatory Economics.

Robin A. Prager is a senior adviser in the Division of Research and Statistics at the Board of Governors of the Federal Reserve System. She joined the Board staff in 1994 as an economist in the Financial Structure Section, and served as chief of the Financial Structure Section from 2000 to 2007. Throughout her tenure at the Board, Prager has been involved in conducting economic analysis of issues relating to the structure and performance of the financial services sector, with an emphasis on banking. Recently, much of her attention has been devoted to issues surrounding the availability of credit to small businesses and the role of community banks in the U.S. financial system. Prager received a bachelor's degree in economics from Harvard University and a doctorate in economics from the Massachusetts Institute of Technology. Prior to joining the staff of the Federal Reserve Board, Prager served on the faculty of the Owen Graduate School of Management at Vanderbilt University. She has also been a visiting faculty member at Boston University's School of Management and MIT's Sloan School of Management, and a visiting senior policy scholar at Georgetown University's Center for Business and Public Policy. She currently serves on the board of the Industrial Organization Society and on the editorial boards of the Review of Industrial Organization and Journal of Regulatory Economics. Edward "Ned" S. Prescott is a senior professional economist in the research department of the Federal Reserve Bank of Cleveland. His research focuses on banking, financial markets and contract theory. Prior to joining the Cleveland Fed in 2015, he was a vice president and economist in the research department of the Federal Reserve Bank of Richmond. In spring of 2004, he visited the Bank of Spain and was a visiting professor at CEMFI in Madrid. He also taught at the University of Virginia. Prescott is an associate editor of Economic Theory and the Journal of Financial Services Research. He has published articles in journals such as the Journal of Political Economy, the Review of Economic Studies, and the Review of Financial Studies. He holds a Bachelor of Arts degree from Swarthmore College and a Ph.D. in economics from the University of Chicago.

Edward "Ned" S. Prescott is a senior professional economist in the research department of the Federal Reserve Bank of Cleveland. His research focuses on banking, financial markets and contract theory. Prior to joining the Cleveland Fed in 2015, he was a vice president and economist in the research department of the Federal Reserve Bank of Richmond. In spring of 2004, he visited the Bank of Spain and was a visiting professor at CEMFI in Madrid. He also taught at the University of Virginia. Prescott is an associate editor of Economic Theory and the Journal of Financial Services Research. He has published articles in journals such as the Journal of Political Economy, the Review of Economic Studies, and the Review of Financial Studies. He holds a Bachelor of Arts degree from Swarthmore College and a Ph.D. in economics from the University of Chicago.

Nathan Ross is a director of legislative policy at the Conference of State Bank Supervisors. In this role, he develops and represents legislative policy positions for state regulators before the U.S. Congress. In addition to legislative outreach, Ross’s portfolio includes community bank regulatory issues, U.S. operations of foreign banks, and global regulatory reform initiatives. He also staffs the state banking supervisor who serves on the Financial Stability Oversight Council. Ross holds bachelor’s degrees in managerial finance, and banking and finance from the University of Mississippi, and a master’s in European Studies from the Universidad de Sevilla.

Nathan Ross is a director of legislative policy at the Conference of State Bank Supervisors. In this role, he develops and represents legislative policy positions for state regulators before the U.S. Congress. In addition to legislative outreach, Ross’s portfolio includes community bank regulatory issues, U.S. operations of foreign banks, and global regulatory reform initiatives. He also staffs the state banking supervisor who serves on the Financial Stability Oversight Council. Ross holds bachelor’s degrees in managerial finance, and banking and finance from the University of Mississippi, and a master’s in European Studies from the Universidad de Sevilla.

John W. Ryan is the president and CEO of the Conference of State Bank Supervisors, the national association representing state banking supervisors and the leading advocate for advancing the state banking system. Before being named CSBS president and CEO in August 2011, Ryan was CSBS's executive vice president, a position he had held since October 2003. He first joined CSBS in 1997 as an assistant vice president for legislative affairs. Prior to joining CSBS, Ryan worked at Newmyer Associates, a public affairs consulting firm, where he led the company's financial services consulting practice. Previous to his work at Newmyer Associates, Ryan spent four years as a professional staff member to the U.S. House of Representatives Committee on Banking, Finance and Urban Affairs. Ryan received a bachelor's degree in political science and economics from the University of California-Berkeley.

Reid Ryan is a founding investor and board member for R Bank and R Corp Financial, Round Rock, Texas. He is also the president for business operations for the Houston Astros Baseball Club. Reid is one of the youngest team presidents in the game and brings enthusiasm and energy to the organization, while also providing a wealth of experience working in professional baseball. From day one, Reid has emphasized the importance of the fan experience and has made it a personal mission to openly engage with the Astros fan base. At nearly every home game, Reid can be found in the stands, speaking with Astros fans on a personal level. Within a few weeks of starting his new position and making his rounds through the ballpark, Reid used that fan feedback to make some changes. He followed up on a specific request to have the ballpark opened earlier in order to give fans access to Astros batting practice, which is now stadium policy. Whether he’s in the ballpark on game days or on the Astro’s Community Leaders ball fields participating in youth baseball and softball clinics with local at-risk children and teens, Reid takes pride in being an active member of the Houston community. Before joining the Astros, Reid was the founder and CEO of both the Corpus Christi Hooks and the Round Rock Express minor league franchises, both of which are perennially lauded as two of the top franchises in minor league attendance, stadium satisfaction and franchise value. Shortly after coming on board in Houston, Reid continued to affect positive change by bringing the Corpus Christi Hooks into the fold as an owned and operated affiliate of the Houston Astros. The Round Rock Express remains the Triple A affiliate of the Texas Rangers. Reid’s history with Texas baseball goes back decades. During the 1980s, Reid was a bat boy for the Astros while his father and Hall of Famer Nolan was an All-Star pitcher in the Astrodome. He later pitched at the University of Texas and Texas Christian University, playing a part in two Southwest Conference Titles. Reid went on to pitch in the minor leagues for two seasons (1994-95) in the Rangers system after being selected in the 17th round of the June 1994 draft. A long-time respected member of minor league baseball’s leadership group, Reid has maintained his ownership interests in the Pacific Coast League’s Round Rock Express. He currently serves as the Texas League (Corpus Christi Hooks) Board of Trustees representative and is the finance chairman for Minor League Baseball.