Welcome and Introduction President Musalem

Morning Keynote Governor Barr

Community Banker Keynote - Price

2025 John Ryan Award

Community Banker Spotlight 2025: Alexander Price, Citizens State Bank, Ouray, Colorado

Welcoming Remarks - Charlie Clark

Morning Keynote with Governor Bowman

John Ryan Award

2024 Liz Magennis

Community Banker Spotlight 2023: Jeff Szyperski, Chesapeake Bank

Community Banker Keynote Jeff Szyperski

Welcoming Remarks - Lise Kruse

Morning Keynote with Governor Bowman

Welcoming Remarks President Schmid

2025 CSBS Annual Survey of Community Banks Presentation of Results

2025 CSBS Community Bank Case Study Competition Winning Presentation

Afternoon Plenary - Andrew Felton

Research Session 1- Banks’ Images: Evidence from Financial Advertising

Community Banker Keynote - Alexander Price

Concluding Remarks: Ken Heinecke

Day One Reflections: Carl White

Day Two: Morning Keynote- Governor Michael Barr

Day Two: Morning Keynote Introduction- President Alberto Musalem

Keynote Introduction- Kara Hunter

Morning Keynote Brandon Milhorn

Panel: Buy, Sell, Create, Redefine

Poster Presentation Ruinan Liu

Mission Driven Lenders

Presentation of John W Ryan Award

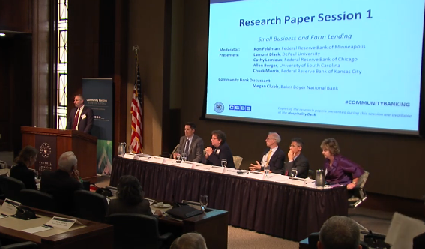

Research Paper Session 1: Academic Moderator Elizabeth Berger

Research Paper Session 1 - Poverty Spreads in Deposit Markets

Research Paper Session 1: Q&A

Research Paper Session 1 -The Decline of Branch Banking

Research Paper Session 2: Academic Moderator Chris James

Research Paper Session 2: Bad Bank, Bad Luck? Evidence from 1 Million Firm-Bank Relationships

Research Paper Session 2: Q&A

Research Paper Session 2: Supervising Failing Banks

Research Paper Session 2- When Banks Fail: Depositor Attention and the Cost of Funding for Survivors

Research Paper Session 3: Academic Moderator John Hackney

Research Paper Session 3: Data as Collateral

Research Paper Session 3: Q&A

Research Paper Session 3: Regulation Meets Technology

Research Paper Session 3: U.S. Banks’ Artificial Intelligence and Small Business Lending

Research Session 1: Community Bank Discussant Bill Bickle

Research Session 2: Community Bank Discussant Jim Edwards

Research Session 3: Community Bank Discussant Kenneth Kelly

Welcome Remarks - Vice Chair for Supervision Michelle Bowman

Welcoming Remarks Tony Salazar

Fuchs Welcoming Remarks

President Musalem Opening Remarks

Charlie Clark Opening Remarks

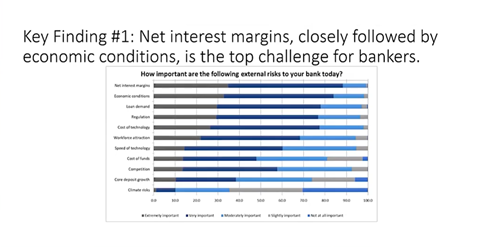

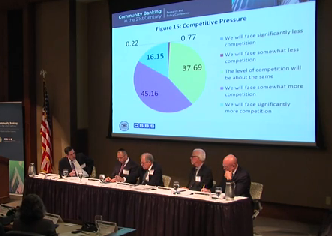

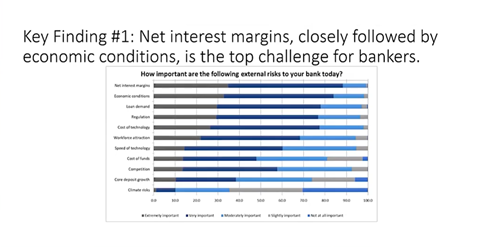

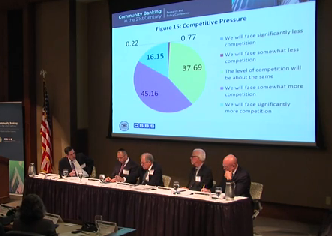

2024 CSBS Annual Survey

Keynote from Governor Bowman

Research Session One - Introduction

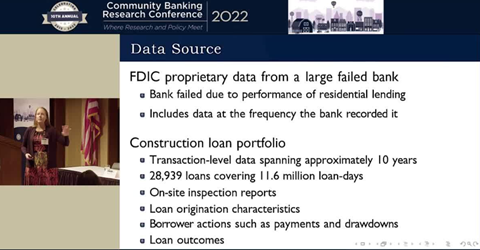

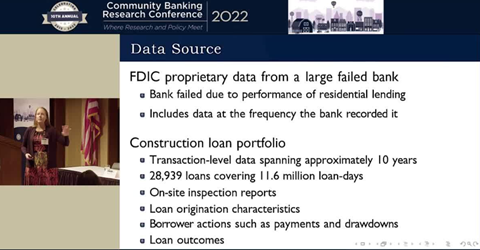

Research Session One - Greg Nini

Research Session One - Williamson

Research Session 1 - Shohini Kundu

Research Session One - Holod

Research Session One - T Corey Neil

Research Session One - QA

Chairman Gruenberg

Research Session Two - Introduction

Research Session Two - Kim

Research Session Two - Emin

Research Session Two - Narayanan

Research Session 2 - Mary Willis

Research Session 2 - Plosser

Research Session Two - QA

Case Study Introduction - Antonio Salazar

CSBS Case Study

CSBS Case Study QA

Day One Reflections Carl White

Justin Zimmerman Remarks

Community Banker Conversation - Magennis

Jeff Schmid

Research Session Three Cathy Zhang

Research Session 3 - Kleymenova

Research Session 3 - Cespedes

Research Session 3 - Orv Kimbrough

Research Session 3 - Beatty

Research Session Three - QA

Panel Discussion The Future of the Community Bank Business Model

John W Ryan Award

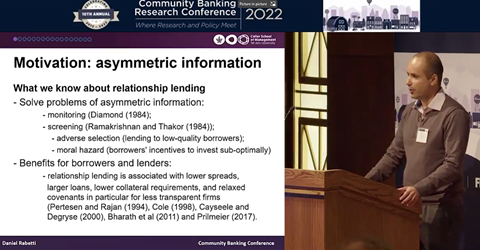

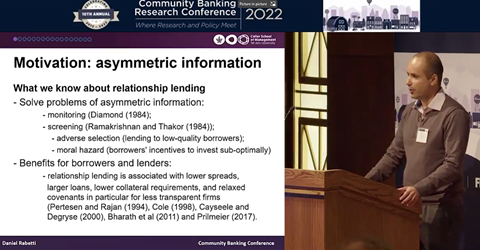

Banking on Deposit Relationships: Implications for Hold-Up Problems in the Loan Market

Credit Union Expansion and Bifurcation in Local Bank Lending

Introduction Interim President O'Neill Paese

Introduction Jim Fuchs

Welcoming Remarks - Lise Kruse

Welcoming Remarks President Schmid

Morning Keynote with Governor Bowman

2023 CSBS Annual Survey Findings

Research Session 1 - Academic Moderator Loutskina

Research Session 1 - Gelman

Research Session 1 - Kim

Research Session 1 - Cookson

Research Session Community Bank Discussant - Hageboeck

Research Session 1 - QA

Afternoon Keynote Chairman Gruenberg

Research Session 2 - Karolyi

Research Session 2 - Gallagher

Research Session 2- Kowalewski

Research Session 2 - Ivanov

Research Session 2 - Anderson

Research Session 2 - QA

CSBS Case Study

CSBS Case Study Faculty Advisor

CSBS Case Study - Charles Clark

Day One Closing Remarks

Introduction by Joe Face for Community Banker Keynote

Community Banker Keynote Jeff Szyperski

Research Session 3 - Karolyi

Research Session 3 - Vij

Research Session 3 - Wirth

Research Session 3 - Pennacchi

Research Session 3 - Foster

Research Session 3 - QA

Panel Discussion

Closing Remarks from James Cooper

Poster Session Jing Huang

Poster Session Sydney Kim

2022 Community Banking Research Conference Highlights

Welcoming Remarks

Welcoming Remarks President Bullard

Welcoming Remarks Tom Fite

Remarks from Chair Powell

National Survey Covington and Siems

National Survey Samowitz

Keynote by Governor Bowman

Research Session 1 Heitz

Research Session 1 Weitzner

Research Session 1 Rabetti

Research Session 1 Garufis

Research Session 1 Flannery

Research Session 1 QA

Special Remarks from Esther George

Keynote from Chairman Gruenberg

Research Session 2 Huang

Research Session 2 Langford

Research Session 2 Li

Research Session 2 Miller

Research Session 2 Jiang

Research Session 2 QA

Case Study Competition

Day 1 Reflection Carl White

Community Banker Keynote Clayton Legear

RS3 Amy Hutton

RS3 Oktay Ucran

RS3 Cindy Vojtech

RS3 Allison Nicoletti

RS3 Luanne Cundiff

RS3 QA

Panel Discussion

Wrap-up Lise Kruse

Poster Session Natee Amornsiripanitch

Poster Session Jennifer Rhee

Welcome: Jim Fuchs

Presentation of Findings from the 2021 CSBS National Survey of Community Banks

Bullard Remarks

Governor Bowman Keynote Remarks

Research Paper Session 1: Government Loan Guarantees in a Crisis: Bank Protections from Firm Safety Nets

Research Paper Session 1:The Effect of the PPPLF on PPP Lending by Commercial Banks

Research Paper Session 1: Academic Moderator Greg Udell

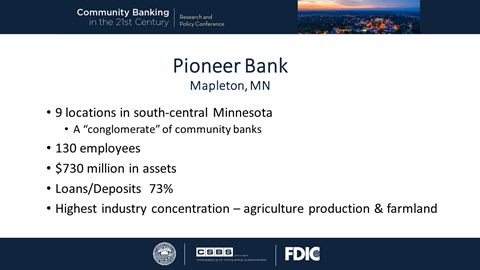

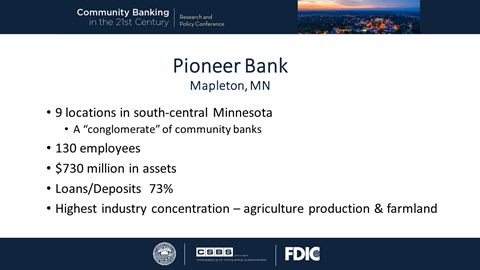

Research Paper Session 1: Community Bank Discussant David Krause

Research Paper Session 1: Q&A

Research Paper Session 2: Academic Moderator Taylor Begley

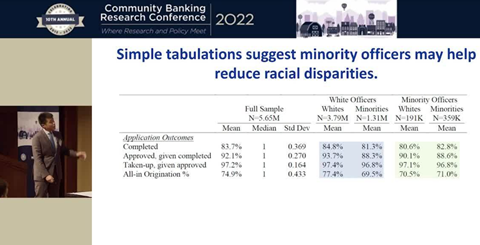

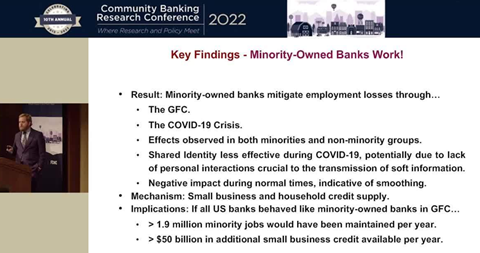

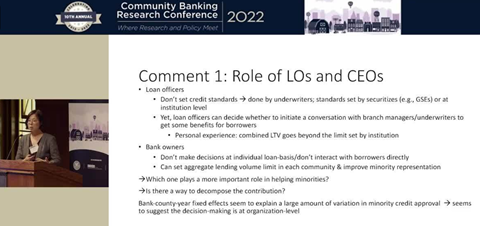

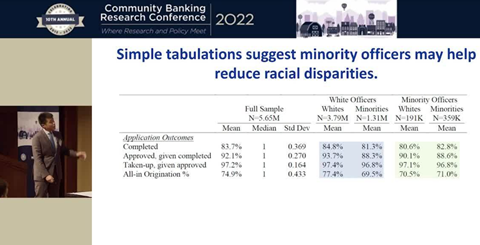

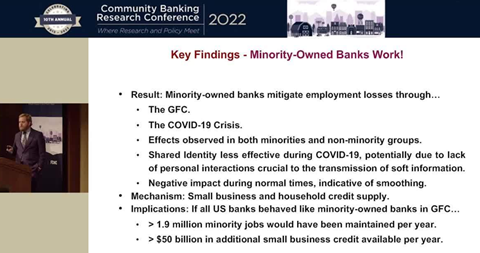

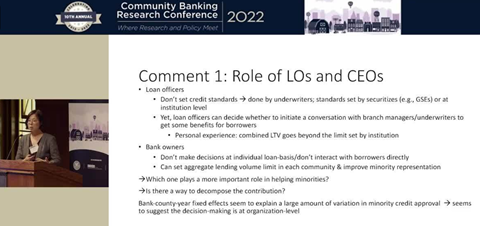

Research Paper Session 2: Do Minority Banks Matter?

Research Paper Session 2: Do Mortgage Lenders Compete Locally? Implications for Credit Access

Research Paper Session 2: Community Bank Discussant Dominik Mjartan

Research Paper Session 2: Q&A

Chairman Jelena McWilliams Keynote Remarks

Day 1 Wrap-Up: Carl White

Keynote by Darrin Williams, Southern Bancorp

Keynote Introduction- Susannah Marshall

CSBS Case Study

Research Paper Session 3: Strategically Staying Small: Regulatory Avoidance and the Community Reinvestment Act

Research Paper Session 3: Small Bank Financing and Funding Hesitancy in a Crisis: Evidence from the Paycheck Protection Program

Research Paper Session 3: Academic Moderator Christina Bouwman

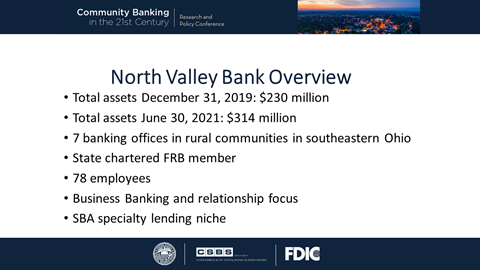

Research Paper Session 3: Community Bank Discussant James Nicholson

Research Paper Session 3: Q&A

Research Paper Session 4: The Real Effects of Bank Supervision: Evidence from On-Site Bank Inspections

Research Paper Session 4: The Life Cycle of a Bank Enforcement Action and Its Impact on Minority Lending

Research Paper Session 4: Community Bank Discussant CK Lee

Research Paper Session 4: Q&A

Research Paper Session 4: Moderator João Santos

Panel- Future of Commercial Real Estat

Day 2 Wrap-Up: John Ryan

Determinants of Losses on Construction Loans: Bad Loans, Bad Banks, or Bad Markets?

Fighting Failure: The Persistent Real Effects of Resolving Distressed Banks

Mandatory Disclosure and Takeovers: Evidence from Private Banks

Presentation of Findings from the 2020 CSBS National Survey of Community Banks

Research Paper Session 1: Moderator and Discussant Response

Research Paper Session1: Q&A

Governor Bowman Keynote Remarks

McWilliams Keynote Conversation with Diane Ellis

President Bullard and Carl White Post-Plenary Session

Research Paper Session 1: The Future of Community Banking

Shared Destinies? Small Banks and Small Business Consolidation

Bank Entrepreneurs

Research Paper Session 2: Moderator Lamont Black and Discussant Alden McDonald, Jr.

Research Paper Session 2: Q&A

Research Paper Session 1: “Revitalize or Stabilize”: Does Community Development Financing Work?

The Propagation of Local Credit Shocks: Evidence from Hurricane Katrina

Day 1 Wrap-up

Measurement of Small Business Lending Using Call Reports: Further Insights from the Small Business Lending Survey

Cyberattacks on Small Banks

Banks, Household Credit Access and Intergenerational Economic Mobility

Government-Sponsored Wholesale Funding and the industrial Organization of Bank Lending

How Important Is Moral Hazard For Distressed Banks?

Insurance Pricing, Distortions, and Moral Hazard. Quasi-experimental Evidence from Deposit Insurance

Keynote by Laurie Stewart, Sound Community Bank

Research Paper Session 3: Moderator and Discussant Response

Research Paper Session 3: Q&A

Research Paper Session 4: Moderator and Discussant Response

Research Paper Session 4: Q&A

2020 CSBS Winning Case Study Presentation: Mississippi State University

Panel Discussion: Community Banking in the Time of COVID-19

Day 2 Wrap-up

Welcome: Julie Stackhouse, Executive Vice President, Supervision Federal Reserve Bank of St. Louis

Welcome: Bret Afdahl Chairman, Conference of State Bank Supervisors Director of Banking, South Dakota Division of Banking

Welcome: James Bullard, President and CEO Federal Reserve Bank of St. Louis

Morning Keynote: Michelle Bowman, Governor, Board of Governors of the Federal Reserve System

Discussion of The 2019 CSBS National Survey of Community Banks

Research Paper Session 1: Who's Holding the Bag? Regulatory Compliance Pressure and Bank Risk-Shifting

Research Paper Session 1:To Ask or Not to Ask? Bank Capital Requirements and Loan Collateralization

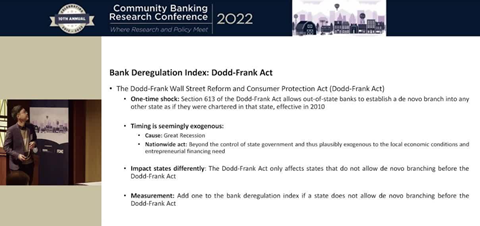

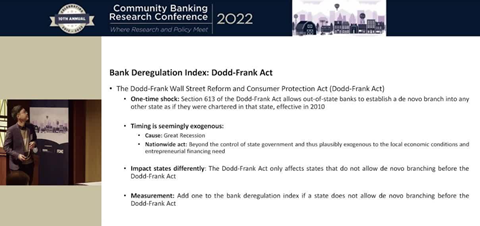

Research Paper Session 1:Is There a Benefit from Reduced Regulation on Small Banks?

Research Paper Session 1: Moderator Diane Ellis and Community Discussant Lori Maley

Research Paper Session 1: Moderated Q&A

Afternoon Keynote: Jelena McWilliams, Chairman, FDIC

Research Paper Session 2: Capital Mobility and Regulation Frictions: Evidence from U.S. Lottery Winners

Research Paper Session 2:Natural Disasters, Loan Loss Accounting and Subsequent Lending

Research Paper Session 2: Bank Branching Networks and Geographic Contagion of Oil Price Shocks

Research Paper Session 2: Moderator Reaction, Thomas Siems, CSBS

Research Paper Session 2: Community Bank Discussant Gary Petersen, Chairman, Cornerstone Bank, New Town, N.D.

Research Paper Session 2: Moderated Q&A

Research Paper Session 3: Risk-shifting, Regulation and Government Assistance

Research Paper Session 3:Deregulation, Market Structure and the Demise of Old School Banking

Research Paper Session 3: Reliance on Third Party Verification in Bank Supervision

Research Paper Session 3: Moderator Reaction Michael Gibson Director, Division of Supervision and Regulation, Board of Governors of the Federal Reserve System

Research Paper Session 3: Community Bank Discussant Craig Goodlock, Chairman and CEO, Farmers State Bank of Munith, Munith, Mich.

Research Paper Session 3: Moderated Q&A

2019 CSBS Community Bank Case Study Competition

Evening Keynote: Julieann Thurlow, President and CEO, Reading Cooperative Bank, Reading, Mass.

Morning Keynote: Patrick Harker, President and CEO, Federal Reserve Bank of Philadelphia

Research Paper Session 4: Small Bank Lending in the Era of Fintech and Shadow Banking: A Sideshow?

Research Paper Session 4: What is Fueling the Fintech Lending Revolution? Local Banking Market Structure and Fintech Market Penetration

Research Paper Session 4: Bank Technology: Productivity and Employment

Research Paper Session 4: Moderator Reaction Traci Mach, Principal Economist, Board of Governors of the Federal Reserve System

Research Paper Session 4: Community Bank Discussant Michael Busch, President and CEO, Burling Bank, Chicago, Ill.

Research Paper Session 4: Moderated Q&A

Panel Discussion: The Future of Funding

2019 Conference Wrap Up: John Ryan, CSBS

Opening Keynote Address: Loretta Mester, president and CEO, Federal Reserve Bank of Cleveland

Welcoming Remarks: Charlotte Corley, commissioner, Mississippi Department of Banking and Consumer Finance; chairman, Conference of State Bank Supervisors (CSBS)

Welcoming Remarks: Julie Stackhouse, executive vice president, Federal Reserve Bank of St. Louis

Welcoming Remarks: James Bullard, president and CEO, Federal Reserve Bank of St. Louis

Research Paper Session 1: Did Bank Small-Business Lending in the U.S. Recover After the Financial Crisis?

Research Paper Session 1:How Important are Local Community Banks to Small Business Lending? Evidence from Mergers and Acquisitions

Research Paper Session 1: Remote Competition and Small Business Loans: Evidence from SBA Lending

Research Paper Session 1: Similarities and Differences in Small Business Lending Between Small and Large Banks: Findings from the Small Business Lending Survey

Research Session 1: Moderator Reaction

Research Session 1: Community Bank Discussant, Janet Garufis, chairman and CEO, Montecito Bank and Trust, Santa Barbara, Calif.

Research Paper Session 1: Moderated Q&A

2018 CSBS Community Bank Case Study Competition: Introduction, Brett Afdahl, director of banking, South Dakota Division of Banking; chair-elect, Conference of State Bank Supervisiors; Winning Team Eastern Kentucky University

2018 CSBS Community Bank Case Study: Moderated Q&A

Day One Closing Remarks: Jelena McWilliams, chairman, Federal Deposit Insurance Corp.

Evening Keynote Address: Gerard Cuddy, president and CEO, Beneficial Bank, Philadelphia, Pa.

Morning Keynote Address: Randal K. Quarles, Vice Chairman for Supervision, Board of Governors of the Federal Reserve System

Morning Keynote Address: Moderated Q&A

Research Paper Session 2:The Effects of Competition in Consumer Credit Markets

Research Paper Session 2: The Competitive Effects of Megabanks on Community Banks

Research Paper Session 2: Depositors Disciplining Banks: The Impact of Scandals

Research Paper Session 2 Moderator Reaction: Dr. Timothy Koch, University of South Carolina

Research Paper Session 2: Community Bank Discussant, Gilda Nogueira, president and CEO, East Cambridge Savings Bank, Cambridge, Mass.

Research Paper Session 2 Moderated QA

Research Paper Session 3: CEO Succession and Performance at Rural Banks

Research Paper Session 3: Stress Testing Community Banks

Research Paper Session 3:Home Biased Credit Allocations

Research Paper Session 3: Technology Investment, Firm Performance and Market Value: Evidence from Banks

Research Paper Session 3: Moderator Reaction, Elizabeth Kiser, associate director and economist, Board of Governors of the Federal Reserve System

Research Paper Session 3: Community Bank Discussant, Thomas Hough, CEO, Carrollton Bank, Carrollton, Ill.

Research Paper Session 3: Moderated Q&A

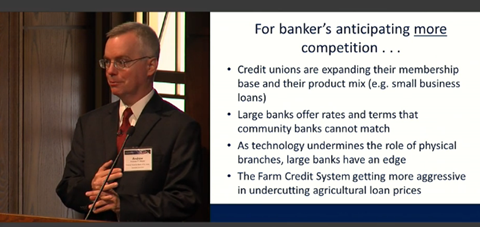

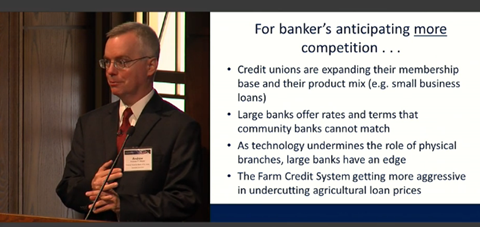

2018 National Survey of Community Banks: Presentation of Results

Panel Discussion: The Future of Community Banking

2018 Conference Wrap Up: John Ryan, CSBS

Welcoming Remarks: Albert Forkner, commissioner, Wyoming Division of Banking; chairman, Conference of State Bank Supervisors (CSBS)

Welcoming Remarks: Julie Stackhouse, executive vice president, Supervision, Federal Reserve Bank of St. Louis

Opening Remarks: Janet Yellen, chair, Board of Governors of the Federal Reserve System

Research Paper Session 1: Robert DeYoung, University of Kansas (KU) School of Business

Research Paper Session 1: The Effect of Bank Supervision on Risk-Taking: Evidence from a Natural Experiment

Research Paper Session 1: Does Bank Supervision Matter? Evidence from Regulatory Office Closures

Research Paper Session 1: Rules and Judgment in the Oversight of Bank Accounting Practice

Research Paper Session 1: Moderator Reaction

Research Paper Session 1: Community Bank Discussant, Martin Birmingham, Five Star Bank, Rochester, Ny.

Research Paper Session 1: Moderated Q&A

2017 CSBS Community Bank Case Study Competition: Introduction, Charlotte Corley, commissioner, Mississippi Department of Banking and Consumer Finance

2017 CSBS Community Bank Case Study Competition: Winning Team, The University of Akron

2017 CSBS Community Bank Case Study Competition: Moderated Q&A

Evening Keynote Address: Cynthia Blankenship, Bank of the West, Grapevine, Texas

Morning Keynote Address: John Williams, president and chief executive officer, Federal Reserve Bank of San Francisco

Morning Keynote Address: Q&A

Research Paper Session 2: Core Profitability of Community Banks, 1995-2015

Research Paper Session 2: Competition and Bank Fragility

Research Paper Session 2: Regulatory Asset Thresholds and Acquisition Activity in the Banking Industry

Research Paper Session 2: Community Bank Discussant, Kevin Riley, First Interstate Bank, Billings, Mont.

Research Paper Session 2: Moderator Reaction, Allen Berger, Darla Moore School of Business, University of South Carolina

Research Paper Session 2: Moderated Q&A

Research Paper Session 3: Financial Crises and Filling the Credit Gap: The Role of Government-guaranteed Loans

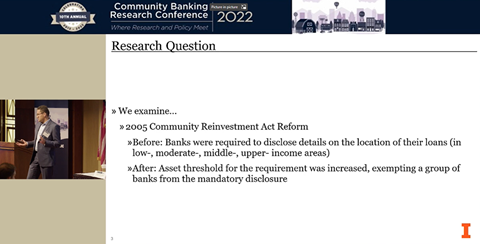

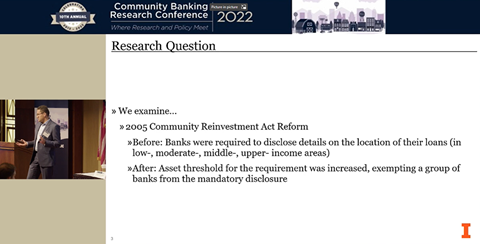

Research Paper Session 3: The Real Effects of Geographic Lending Disclosure on Banks

Research Paper Session 3: Color and Credit: Race, Regulation and the Quality of Financial Services

Research Paper Session 3: Community Bank Discussant, Peter Schork, Ann Arbor State Bank, Ann Arbor, Mich.

Research Paper Session 3: Moderator Reaction, Tim Yeager, Sam M. Walton College of Business, University of Arkansas

Research Paper Session 3: Moderated Q&A

2017 National Survey of Community Banks: Presentation of Results

Community Banking in the 21st Century: Panel Discussion

Community Banking in the 21st Century: Panel Discussion Q&A

2017 Conference Wrap-Up: John Ryan, CSBS

Day 1 Welcome: Julie Stackhouse, Executive Vice President, Supervision, Federal Reserve Bank of St. Louis

Welcoming Remarks: Charles G. Cooper, commissioner, Texas Department of Banking; chairman, Conference of State Bank Supervisors (CSBS)

Welcoming Remarks: James Bullard, president and CEO, Federal Reserve Bank of St. Louis

Research Paper Session 1: Moderator Robin A. Prager, Board of Governors of the Federal Reserve System

Research Paper Session 1: Is the Traditional Banking Model a Survivor?

Research Paper Session 1: Bank Business Models in the U.S.: Identification, Performance, Risks and Regulation

Research Paper Session 1: Why Banks Matter: Measuring the Impact of Banks on Missouri’s Economy

Research Paper Session 1: The Changing Face of Communities Served by Minority Depository Institutions: 2001 - 2014

Research Paper Session 1: Moderator Reaction

Research Paper Session 1: Community Bank Discussant: William Dana Jr., president and chief executive officer, Central Bank of Kansas City, Kansas City, Mo.

Research Paper Session 1: Moderated Q&A

Afternoon Keynote Address: Charles Evans, president and CEO, Federal Reserve Bank of Chicago

Afternoon Keynote Address Q&A: Charles Evans, president and CEO, Federal Reserve Bank of Chicago

Research Paper Session 2: Moderator Cynthia L. Course, director, financial institution supervision and credit, Federal Reserve Bank of San Francisco

Reserach Paper Session 2: Is Bigger Necessarily Better in Community Banking?

Research Paper Session 2: Bank Size, Compliance Costs and Compliance Performance in Community Banking

Research Paper Session 2: Has the Relationship Between Bank Size and Profitability Changed?

Research Paper Session 2: Moderator Reaction

Research Paper Session 2: Community Bank Discussant: Allan (Al) Landon, general partner, Community BanCapital, Portland, Ore.

Research Paper Session 2: Moderated Q&A

Presentation of Winning Case Study and Video from the 2016 CSBS Community Bank Case Study Competition: Southeastern Louisiana University

2016 CSBS Community Bank Case Study Competition Presentation: Moderated Q&A

Evening Keynote Address: H.E. “Gene” Rainbolt, chairman, BancFirst Corporation, Oklahoma City, Okla.

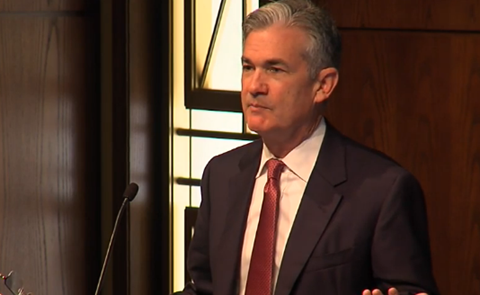

2016 Morning Keynote Address: Governor Jerome Powell, Board of Governors of the Federal Reserve System

Morning Keynote Q&A

Research Paper Session 3: Moderator Todd Vermilyea, Federal Reserve Board of Governors

Research Paper Session 3: Did Capital Requirements in the Early 20th Century U.S. Promote Bank Stability?

Research Paper Session 3: Dodd-Frank Federal Deposit Insurance Reform

Research Paper Session 3: Commercial Lending Concentration and Bank Expertise: Evidence from Borrower Financial Statements

Research Paper Session 3: Moderator Reaction

Research Paper Session 3: Community Bank Discussant: Glen Jammaron, vice chairman and president, Alpine Banks of Colorado, Glenwood Springs, Colo.

Research Paper Session 3: Moderated Q&A

2016 National Survey of Community Banks: Presentation of Results

2016 Panel Discussion: Moderator, Melanie Hall, commissioner, Montana Division of Banking and Financial Institutions

2016 Panel Discussion: Lori Bettinger, executive vice president, Alliance Partners; president, BancAlliance

2016 Panel Discussion: Ann Marie Mehlum, associate administrator, U.S. Small Business Administration (SBA)

2016 Panel Discussion: Richard Sanborn, president and chief executive officer, Seacoast Commerce Bank, San Diego, Calif.

2016 Panel Discussion: Darrin L. Williams, chief executive officer, Southern Bancorp, Inc., Arkadelphia, Ark.

2016 Panel Discussion: How do you see regulatory burden impacting the community banking industry in the short term? Long term?

2016 Panel Discussion: Looking ahead 10 years, what aspects of the community bank business model will undergo the most dramatic change? Which will likely remain unchanged?

2016 Panel Discussion: Moderated Q&A

2016 Conference Wrap-up: Michael Stevens, CSBS

Welcoming Remarks: Julie Stackhouse, senior vice president, Federal Reserve Bank of St. Louis

Welcoming Remarks: David J. Cotney, commissioner of banks, Massachusetts Division of Banks; chairman, Conference of State Bank Supervisors

Welcoming Remarks: James Bullard, president and CEO, Federal Reserve Bank of St. Louis

Opening Remarks: Janet Yellen, chair, Board of Governors of the Federal Reserve System

Research Paper Session 1: Moderator Ron Feldman, executive vice president and senior policy advisor, Federal Reserve Bank of Minneapolis

Research Paper Session 1: Discussant Megan F. Clubb, chairman and chief executive officer, Baker-Boyer National Bank, Walla Walla, Wash.

Research Paper Session 1: The Changing Role of Small Banks in Small Business Lending

Research Paper Session 1: Lending on Main Street: Challenges and Opportunities for Community Banks- Before, During and After the Financial Crisis

Research Paper Session 1: Small Bank Comparative Advantage in Alleviating Financial Constraints and Providing Liquidity Insurance over Time

Research Paper Session 1- How does Farm Credit System Lending Affect Competition in Banking Markets?

Research Paper Session 1: Moderator Reaction

Research Paper Session 1: Q&A

Presentation of Winning Video from CSBS' 2015 Inaugural Community Bank Case Study Competition

2015 Evening Keynote Address: Lael Brainard, governor, Board of Governors of the Federal Reserve System

Research Paper Session 2: Moderator Julapa Jagtiani, special advisor, Supervision, Regulation and Credit Department, Federal Reserve Bank of Philadelphia

Research Paper Session 2: Discussant Charles A. Paul, III (Chad Paul), director-member, North Carolina State Banking Commission; managing partner, Harbor Island Partners, LLC, Wilmington, N.C.

Research Paper Session 2: Did the Financial Reforms of the Early 1990s Fail? A comparison of Bank Failures and FDIC Losses in the 1986 – 1992 and 2007 – 2013 Periods

Research Paper Session 2: Financial Performance and Managment Structure of Small, Closely-Held Banks

Research Paper Session 2: How Vulnerable are Agriculturally Concentrated Banks to a Fall in Agricultural Land Values?

Research Paper Session 2: An Historical Loss Approach to Community Bank Stress Testing

Research Paper Session 2: Moderator Reaction

Research Paper Session 2: Moderated Q&A

Research Paper Session 3: Moderator Robin A. Prager, senior adviser, division of research and statistics, Board of Governors of the Federal Reserve System

Research Paper Session 3: Discussant Steven A. Brown, president and chief executive officer, Pacific Coast Banker’s Bank (PCBB), Walnut Creek, Calif.

Research Paper Session 3: The State and Fate of Community Banking Video 1

Research Paper Session 3: The State and Fate of Community Banking Video 2

Research Paper Session 3: Accounting for the Decline in the Number of Community Banks since the Great Recession

Research Paper Session 3: The Direct Costs of Bank Compliance around New Regulations for Small and Community Banks

Research Paper Session 3: Post-Crisis Residential Mortgage Lending by Community Banks

Research Paper Session 3: Moderator Reaction

Research Paper Session 3- Moderated QA

Introduction for Keynote Speaker: Charles G. Cooper, commissioner, Texas Department of Banking

2015 Banker Keynote: Reid Ryan, R Bank, Round Rock, Texas

2015 National Survey of Community Banks: Presenation of Results

2015 Panel Discussion: Video 1

2015 Panel Discussion: Video 2

2015 Panel Discussion: Video 3

2015 Panel Discussion: Video 4

Welcoming Remarks: Julie Stackhouse, executive vice president, Federal Reserve Bank of St. Louis

Welcoming Remarks: James Bullard, president, Federal Reserve Bank of St. Louis

Welcoming Remarks-Ryan

Welcoming Remarks-Powell

Morning Keynote Address: Esther L. George, president, Federal Reserve Bank of Kansas City

Research Paper Session 1: Moderator Ken B. Cyree, Ph.D., Dean and the Frank R. Day/Mississippi Bankers Association Chair of Banking, University of Mississippi School of Business Administration; Director, Mississippi School of Banking

Research Paper Session 1: Panelist Mark Schroeder, chairman and CEO, German American Bank, Jasper, Ind.

Research Paper Session 1: The Entry, Performance and Viability of De Novo Banks

Research Paper Session 1: Where Are All the New Banks? The Role of Regulatory Burden in New Charter Creation

Research Paper Session 1: Rivalry, Market Structure and Innovation: The Case of Mobile Banking

Research Paper Session 1: What Explains Low Net Interest Income at Community Banks?

Research Paper Session 1: Moderator Reaction

Research Paper Session 1: Q&A

Research Paper Session 2: Moderator Richard A. Brown, chief economist and associate director for regional operations, Division of Insurance and Research, Federal Deposit Insurance Corporation, Washington, D.C.

Research Paper Session 2: Panelist David C. Williams, president and CEO, Upper Peninsula State Bank, Escanaba, Mich.

Research Paper Session 2: Assessing Targeted Macroprudential Financial Regulation: The Case of the 2006 Commercial Real Estate Guidance for Banks

Research Paper Session 2: The Impact of Small Business Lending Fund on Community Bank Lending to Small Businesses

Research Paper Session 2-When Bank Examiners Get It Wrong: Financial Institution Appeals of Material Supervisory Determinations

Research Paper Session 2: Moderated Q&A

Research Paper Session 3: Moderator Heidi Mandanis Schooner, Columbus School of Law, Catholic University of America, Washington, D.C.

Research Paper Session 3: Panelist J. Pat Hickman, chairman and CEO, Happy State Bank, Happy, Texas

Research Paper Session 3:How Are Small Banks Faring Under Dodd-Frank?

Research Paper Session 3: Did the JOBS Act Benefit Community Banks? A Regression Discontinuity Study

Research Paper Session 3: A Tiered System of Regulation is Needed To Preserve the Viability of Community Banks and Reduce the Risks of Megabanks

Research Paper Session 3: Federal Policy, Market Failures and the Challenge for Community Banks

Research Paper Session 3: Moderated Q&A

Inroduction for Keynote Speaker: Candace A. Franks, CSBS Chairman and Arkansas Commissioner of Banks

Evening Keynote Address: Rebeca Romero Rainey, chair & CEO Centinel Bank, Taos, New Mexico

2014 Community Banker Town Hall Survey Presentation of Results

The Future of Community Banking: Moderator Lamont Black, assistant professor of finance, Driehaus College of Business, DePaul University Chicago, Ill.

The Future of Community Banking: Panel Video 1

The Future of Community Banking: Panel Video 2

The Future of Community Banking: Panel Video 3

The Future of Community Banking: Panel Video 4

The Future of Community Banking: Panel Q&A

Closing Remarks: Julie Stackhouse, senior vice president of the St. Louis Fed’s Banking Supervision and Regulation division

Welcoming Remarks: Julie Stackhouse, senior vice president, Federal Reserve Bank of St. Louis

Welcoming Remarks: John Ryan, president and CEO, Conference of State Bank Supervisors

Welcoming Remarks: James Bullard, president, Federal Reserve Bank of St. Louis

Opening Remarks: Ben Bernanke, chairman, Board of Governors of the Federal Reserve

Research Paper Session 1: Moderator Scott E. Hein, Robert C. Brown Chair in Finance, Rawls College of Business, Texas Tech University, Lubbock, Texas

Research Paper Session 1: Do Community Banks PLay a Role in New Firm Survival?

Research Paper Session 1: Equipment Leasing and Financing: The Role of Community Banks

Research Paper Session 1: Equipment Leasing and Financing: The Role of Community Banks Video 2

Research Paper Session 1: Small Business Lending and Social Capital: Are Rural Relationships Different?

Research Paper Session 1: Bank Failure, Relationship Lending and Local Economic Performance

Research Paper Session 1: Moderated Q&A

Evening Keynote Address: Dorothy A. Savarese, chairman, president and CEO of Cape Cod Five Cents Savings Bank, Orleans, Mass.

Research Paper Session 2: Moderator Richard A. Brown, chief economist and associate director for regional operations, Federal Deposit Insurance Corp., Washington, D.C.

Research Paper Session 2: Financial Derivatives at Community Banks

Research Paper Session 2: Lessons from Community Banks that Recovered from Financial Distress

Research Paper Session 2: Performance of Community Banks in Good Times and Bad Times: Does Management Matter?

Research Paper Session 2: The Effect of Distance on Community Bank Performance Following Acquisitions and Reorganizations

Research Paper Session 2: Moderated Q&A

Research Paper Session 3: Moderator Lamont Black, assistant professor of finance, Driehaus College of Business, DePaul University, Chicago, Ill.

Research Paper Session 3: Estimating Changes in Supervisory Standards and Their Economic Effects

Research Paper Session 3: The Impact of Dodd-Frank on Community Banks

Research Paper Session 3: Capital Regulation at Community Banks: Lessons from 400 Failures

Research Paper Session 3: A Failure to Communicate: The Pathology of Too Big to Fail

Research Paper Session 3: Moderator Wrap-up

Research Paper Session 3: Moderated Q&A

Afternoon Keynote Address: Governor Jerome Powell, Board of Governors of the Federal Reserve System

Presentation of Results from Town Hall: Presenter Mike Stevens, senior executive vice president, Conference of State Bank Supervisors

Community Banking in the 21st Century Panel: Moderator Charles A. Vice, CSBS chairman and Kentucky Department of Financial Institutions commissioner

Community Banking in the 21st Century: Opportunities, Challenges and Perspectives- Panelist Curt Hecker, president and CEO, Panhandle State Bank, Sandpoint, Idaho

Community Banking in the 21st Century: Opportunities, Challenges and Perspectives- Panelist Bobby P. Martin, chairman of the board, The Peoples Bank, Ripley, Miss.

Community Banking in the 21st Century: Opportunities, Challenges and Perspectives- Panelist Thomas E. Spitz, chief executive officer, Settlers Bank, Windsor, Wis.

Community Banking in the 21st Century: Opportunities, Challenges and Perspectives- Panelist Claire W. Tucker, president and CEO, CapStar Bank, Nashville, Tenn.

Community Banking in the 21st Century:Opportunities Challenges and Perspectives- Panel Q&A

Closing Remarks: Julie Stackhouse, senior vice president, Federal Reserve Bank of St. Louis

Community Banker Spotlight 2025: Alexander Price, Citizens State Bank, Ouray, Colorado

2025 Alexander Price

Community Banker Spotlight 2024: Elizabeth Magennis, ConnectOne Bank

Community Banker Spotlight 2023: Jeff Szyperski, Chesapeake Bank

Community Banker Spotlight 2019: Dave Hanson, American State Bank and Trust

Community Banker Spotlight 2019: Buddy Mortimer, Bank of Kilmichael

Community Banker Spotlight 2019: Lori Maley, Bank of Bird-in-Hand

Community Banker Spotlight 2018: Daniel Yates, Brattleboro Savings and Loan

Community Banker Spotlight 2018: Dylan Clarkson, Pioneer Bank and Trust

Community Banker Spotlight 2018: Tom Hough, Carrollton Bank

Community Banker Spotlight 2017: Chuck Mausbach, Frandsen Financial Corporation

Community Banker Spotlight 2017: Lee McCann, Sabine State Bank

Community Banker Spotlight 2017: Craig Reeves, FNB New Mexico

Community Banker Spotlight 2016: John V. Evans Jr., D.L. Evans Bank

Community Banker Spotlight 2016: Joe Kesler, First Montana Bank

Community Banker Spotlight 2016: H.E. "Gene" Rainbolt, BancFirst

Community Banker Spotlight 2016: Claire Tucker, CapStar Financial Holdings

Community Banker Spotlight 2015: John W. Jay, Roscoe State Bank

Community Banker Spotlight 2015: Chris Oddliefson, Rockland Trust

Community Banker Spotlight 2015: Scott Page, CoBiz Bank

Community Banker Spotlight 2015: Gary L. Tice, First Florida Integrity Bank

Community Banker Spotlight 2015: Jim Watson, Midwest BankCentre

2023 Joe Face

2019 Commissioner Perspectives: Lise Kruse of the North Dakota Department of Financial Institutions

Commissioner Perspectives 2019: Charlotte Corley, Mississippi Department of Banking and Consumer Finance

Commissioner Perspectives 2017: Mike Rothman, Minnesota Department of Commerce

Commissioner Perspectives 2017: Christopher Moya, New Mexico Financial Institutions Division

2017 - The Importance of Community Banking

Commissioner Perspectives 2017: John Ducrest, Louisiana Office of Financial Institutions

Commissioner Perspectives 2016: Gavin M. Gee, Idaho Department of Finance

Commissioner Perspectives 2016: Greg Gonzales, Tennessee Department of Financial Institutions

Commissioner Perspectives 2016: Melanie Hall, Montana Division of Banking and Financial Institutions

Community Banking: In Your Community and Beyond

Commissioner Perspectives 2016: Mick Thompson, Oklahoma Banking Department

2017 Commissioner Commentary - Utah

2017 Commissioner Commentary - Hawaii

2017 Commissioner Commentary - Kentucky

2018 Community Banking in the 21st Century Conference Highlights

2017 Community Banking in the 21st Century Conference Highlights

2016 Community Banking in the 21st Century Conference Highlights

2015 Community Banking in the 21st Century Conference Highlights

2014 Community Banking in the 21st Century Conference Highlights

2013 Community Banking in the 21st Century Conference Highlights

2025 CBRC Highlights

2018 Community Bank Case Study Competition Finalist

2017 University of Akron Case Study

2016 Case Study Highlights

2016 Winner's Presentation: Southeastern Louisiana University

2016 Southeastern Louisiana University Case Study

2016 University of Arkansas, Competition Participant

2016 University of Wyoming, Competition Participant

2016 Concordia College, Competition Participant

2015 University of Utah, Competition Participant and 1st Place Winner