Community Banking Research Conference Where Research and Policy Meet

The tenth annual Community Banking Research Conference—sponsored by the Federal Reserve System, the Conference of State Bank Supervisors (CSBS) and the Federal Deposit Insurance Corp. (FDIC)—will be hosted as a hybrid event on Sept. 28 and Sept. 29, 2022. The conference brings together community bankers, academics, policymakers and bank regulators to discuss the latest research on community banking.

The conference presents an innovative approach to the study of community banks. Academics explore issues raised by the industry in a neutral, empirical manner and present their findings at the conference. Community bankers contribute to an annual national survey prior to the conference and then participate directly in the conference by serving as keynote speakers and panelists, and by providing feedback to the research presented. For more information, please contact conference@communitybanking.org.

Conference Agenda

Gateway Auditorium, 6th Floor | Federal Reserve Bank of St. Louis

September 28-29, 2022

Download as PDF

- Wednesday, September 28

-

Welcoming Remarks

-

Special Video Welcome

-

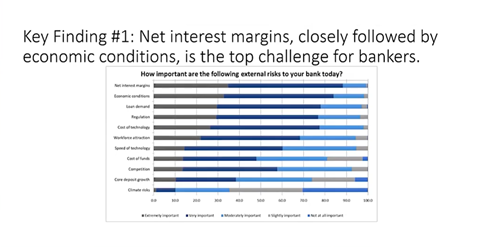

Presentation of Findings from the 2022 CSBS National Survey of Community Banks

-

Morning Keynote

-

Break

-

Research Paper Session 1

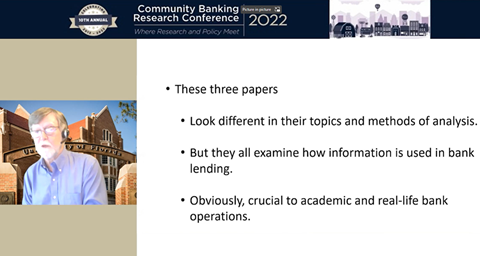

Information and Bank Lending Terms Moderator: Mark Flannery

Moderator: Mark Flannery

Bank of America Eminent Scholar in Finance Chair, University of Florida Warrington College of Business

Community Bank Discussant: Janet Garufis

Community Bank Discussant: Janet Garufis

President and CEO, Montecito Bank and Trust, Santa Barbara, California

Bank Monitoring with On-Site InspectionsAmanda Heitz, Tulane UniversityBank Loan Markups and Adverse SelectionGregory Weitzner, McGill UniversityNon-Information Asymmetry Benefits of Relationship LendingDaniel Rabetti, Tel Aviv UniversityModerator Response -

Lunch

-

Special Video Remarks

-

Afternoon Keynote

-

Break

-

Research Paper Session 2

Minorities’ Access to Credit Moderator: Erica Jiang

Moderator: Erica Jiang

Assistant Professor of Finance and Business Economics, University of Southern California Marshall School of Business

Community Bank Discussant: Jordan Miller

Community Bank Discussant: Jordan Miller

Business and Community Advisor, Jamjr LLC, Powell, Ohio; Proposed CEO and chairman for Adelphi Bank, Columbus, Ohio

The Impact of Minority Representation at Mortgage LendersRuidi Huang, Southern Methodist University“Let Us Put Our Money Together:” Minority-Owned Banks and Resilience to CrisesW. Scott Langford, Arizona State UniversityModerator Response -

2022 CSBS Community Bank Case Study Competition Winning Team Presentation

Introduction: I. Lise Kruse

Introduction: I. Lise Kruse

Commissioner, North Dakota Department of Financial Institutions ; Chair, CSBS

Community Bank PartnerGarth Knight, Executive Vice President and Chief Lending Officer, F&M Bank Corp., Timberville, VA

-

Day One Reflections

-

Dinner Reception

- Thursday, September 29

-

Breakfast and Networking

-

Morning Keynote

Community Banker Keynote Slides -

Research Paper Session 3

Transparency in Supervision and Regulation Moderator: Allison Nicoletti

Moderator: Allison Nicoletti

Assistant Professor of Accounting, Wharton School of the University of Pennsylvania

Community Bank Discussant: Luanne Cundiff

Community Bank Discussant: Luanne Cundiff

President and CEO, First State Bank of St. Charles, St. Charles, Missouri

The Benefits and Costs of Transparent Supervision of Public Banks: Evidence from Disclosure of SEC Comment LettersAmy Hutton, Boston CollegeThe Social Externalities of Bank Disclosure Regulation: Evidence from the Community Reinvestment ActOktay Urcan, University of IllinoisSentiment in Bank Examination Reports and Bank OutcomesCindy Vojtech, Board of Governors of the Federal Reserve SystemQ&A SessionModerator Response -

Break

-

Panel Discussion

Will Technology be the End of Relationship Banking?Panelists Nicole Lorch

Nicole Lorch

President and Chief Operating Officer, First Internet Bank of Indiana, Fishers, Indiana

Panel Discussion -

Conference Wrap-up

-

Additional Selected Papers

The Age Gap in Mortgage AccessNatee Amornsiripanitch, Federal Reserve Bank of Philadelphia

Research Papers, Authors and Key Findings

Research Paper Session 1

Information and Bank Lending Terms

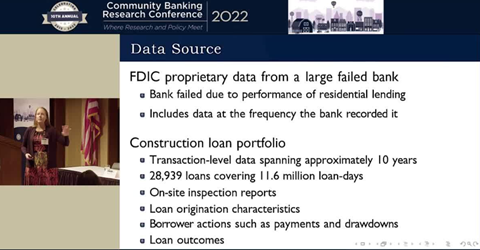

Bank Monitoring with On-Site Inspections

Authors: Amanda Heitz, Tulane University; Alex Ufier, federal-deposit-insurance-corporation---fdic; Chris Martin, federal-deposit-insurance-corporation---fdic

Key Findings: Using a proprietary database of nearly 30,000 multiple-draw construction loans, the authors examine empirically the theoretical determinants of bank monitoring within non-syndicated loans, how banks use the information collected when they monitor, and whether monitoring affects loan outcomes. They show that banks trade off monitoring with more favorable loan origination terms, and negative on-site inspection reports are associated with a greater likelihood of draw denials. They conduct a comprehensive analysis of the determinants of construction loan default and show that more monitoring ultimately decreases loan default.

Bank Loan Markups and Adverse Selection

Authors: Gregory Weitzner, McGill University; Mehdi Beyhaghi, Federal Reserve Bank of Richmond; Cesare Fracassi, University of Texas

Key Findings: The authors analyze market power in local U.S. corporate loan markets. In contrast to typical theories of competition, they find that loan markups are higher in regions in which more banks operate. They provide evidence that this result is driven by asymmetric information across banks, which becomes exacerbated as the number of banks increase. They also provide causal support for the role of adverse selection by showing that markups drop following a shock to large banks’ lending capacities that reduces asymmetric information in local lending markets. Their findings suggest that adverse selection is an important driver of market power in local bank markets and have implications for antitrust policy.

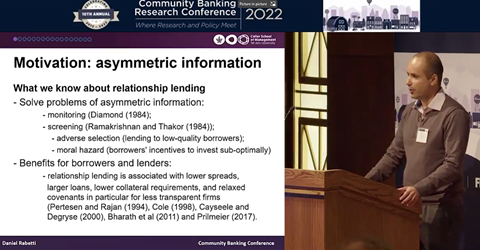

Non-Information Asymmetry Benefits of Relationship Lending

Author: Daniel Rabetti, Tel Aviv University

Key Findings: The author examines the benefits of relationship lending in the Paycheck Protection Program (PPP), a situation where loan credit risk plays little role in the lending decision. He finds that relationship firms—those that receive PPP loans from lenders with whom they have a prior relationship—are granted economically significantly larger loans and faster approvals than transactions firms—those with no such relationships. PPP lenders tend to prioritize relationship firms primarily because of concerns about the increased default risk associated with borrower’s pre-crisis debt. These benefits come with costs, however, as firms are more likely to violate the program’s rules when a relationship exists.

Moderator Response

Research Paper Session 2

Minorities’ Access to Credit

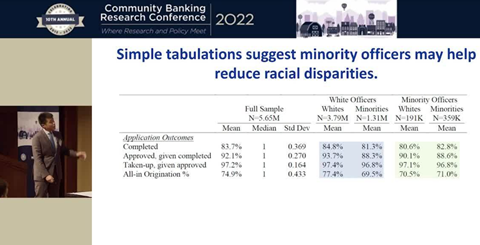

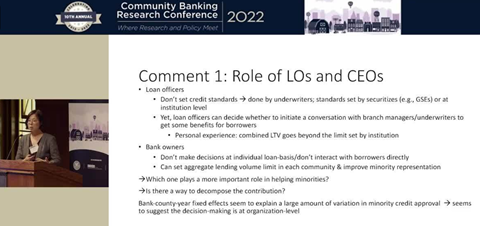

The Impact of Minority Representation at Mortgage Lenders

Authors: Ruidi Huang, Southern Methodist University; Erik Mayer, Southern Methodist University; W. Scott Frame, Federal Reserve Bank of Dallas; Adi Sundaeram, Harvard Business School

Key Findings: The authors use a novel data set that matches mortgage applications to loan officers to examine the links between the labor market for loan officers and access to mortgage credit. They find that minorities are significantly underrepresented among loan officers, and that minority borrowers are less likely to complete mortgage applications, have completed mortgage applications approved and take out a loan. When minority borrowers work with minority loan officers, the authors find, these disparities are greatly reduced and default rates on these loans are lower. They conclude that minority underrepresentation among loan officers adversely affects minority borrowers’ access to credit.

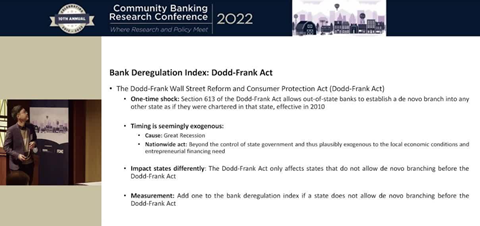

Bank Competition and Entrepreneurial Gaps: Evidence from Bank Deregulation

Author: Xiang Li, Boston College

Key Findings: The author analyzes the effects of bank competition on gender and racial gaps in entrepreneurship, and finds that the increase in competition that followed interstate banking deregulation increased the quantity and quality of banking services provided to minority borrowers. Improved banking services and a reduction in discrimination, the author argues, reduces entrepreneurship gaps by loosening financial constraints on female and minority entrepreneurs, which in turn fosters wealth equality.

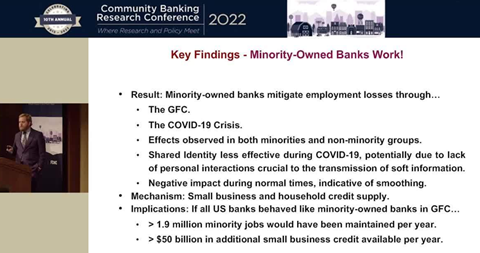

“Let Us Put Our Money Together:” Minority-Owned Banks and Resilience to Crises

Authors: W. Scott Langford, Arizona State University; Allen Berger, Darla Moore School of Business, University of South Carolina; Maryann Feldman, Arizona State University; Raluca Roman, Federal Reserve Bank of Philadelphia

Key Findings: The authors examine whether minority-owned banks’ mission to promote economic well-being in their communities and their use of soft-information-based lending yield advantages in serving community needs during financial and economic crises. Their results suggest that minority-owned banks improved economic resilience in their communities and beyond during the Global Financial Crisis and the COVID-19 Crisis through increases in small business and household lending. Fewer benefits, however, were found during other phases of the business cycle. Their findings are consistent with the predictions of the economic resilience literature.

Moderator Response

Research Paper Session 3

Transparency in Supervision and Regulation

The Benefits and Costs of Transparent Supervision of Public Banks: Evidence from Disclosure of SEC Comment Letters

Authors: Amy Hutton, Boston College ; Xin Zheng, University of British Columbia; Yupeng Lin, National University of Singapore; Susan Shu, Boston College; Ira Yeung, University of British Columbia

Key Findings: The authors analyze the consequences of increased regulatory transparency on banks by examining the effects of the SEC’s 2004 decision to begin publicly disclosing its comment letters, letters only issued to public banks. They find that, compared with private banks, public banks improve the timeliness of their loan loss provisions following this decision. The differences in private and public banks’ lending activities are mixed. Increased transparency leads to slower and more procyclical loan growth for public banks; it also encourages public banks to shift credit toward safer borrowers. The public dissemination of comment letters leads to an increase in funding costs and less regulatory forbearance for the public banks receiving them.

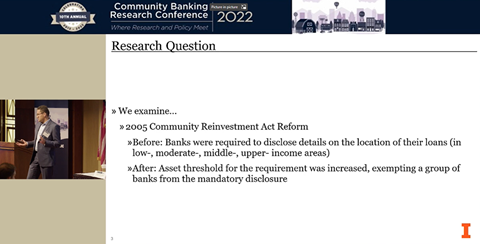

The Social Externalities of Bank Disclosure Regulation: Evidence from the Community Reinvestment Act

Authors: Oktay Urcan, University of Illinois ; Sydney Kim, University of Illinois at Urbana Champaign; Hayoung Yoon, Southern Methodist University

Key Findings: The authors assess the effects of bank disclosure regulations on business activities through an examination of the 2005 reform of the Community Reinvestment Act (CRA), which lifted mandatory disclosure of geographic loan distribution data for certain banks. They found that the disclosure reform led to declines in small business growth, small business employment and wages in low- and moderate-income (LMI) neighborhoods. Using hand-collected data, they also show that non-disclosing banks reduced lending to LMI areas after the reform. Their findings suggest that eliminating disclosure leads to negative externalities for the communities the CRA specifically targets to protect.

Sentiment in Bank Examination Reports and Bank Outcomes

Authors: Cindy Vojtech, Board of Governors of the Federal Reserve System; Maureen Cowhey, Board of Governors of the Federal Reserve System; Jung Lee, Board of Governors of the Federal Reserve System; Thomas Spiller, Board of Governors of the Federal Reserve System

Key Findings: Does the bank examination process provide useful insight into the future outcome of banks? The authors investigate this question by analyzing the text of commercial bank examination reports for small to mid-sized banks over the 2004 to 2016 period. They find that controlling for a variety of factors—including the CAMELS component ratings themselves—the sentiment supervisors express in describing most of the components predict relevant future outcomes. The sentiment conveyed in the asset quality, management, and earnings sections provides significant information in predicting future outcomes for problem loans, supervisory actions, and profitability, respectively.

Q&A Session

Moderator Response

Speakers and Panelists

Michelle W. Bowman took office as the Vice Chair for Supervision of the Board of Governors of the Federal Reserve System on June 9, 2025, for a four-year term. Ms. Bowman has served as a member of the Board of Governors of the Federal Reserve System since taking office on November 26, 2018, to fill an unexpired term ending January 31, 2020. She was reappointed to the Board on January 23, 2020, and sworn in on January 30, 2020, for a term ending January 31, 2034.

Prior to her appointment to the Board, Ms. Bowman served as the state bank commissioner of Kansas from January 2017 to November 2018. She also served as vice president of Farmers & Drovers Bank in Kansas from 2010 to 2017. In addition to her experience in the banking industry, Ms. Bowman worked in Washington, D.C. for Senator Bob Dole of Kansas from 1995 to 1996 and served as a counsel to the U.S. House Committee on Transportation and Infrastructure and the Committee on Government Reform and Oversight between 1997 and 2002. In 2002, Ms. Bowman became director of congressional and intergovernmental affairs at the Federal Emergency Management Agency. From 2003 to 2004, she served as Deputy Assistant Secretary and policy advisor to Homeland Security Secretary Tom Ridge.

Following her time in Washington, D.C., Ms. Bowman led a government and public affairs consultancy based in London before returning to Kansas in 2010. Ms. Bowman received a BS in advertising and journalism from the University of Kansas and a JD from the Washburn University School of Law. She is a member of the New York Bar. Ms. Bowman is married with two children.

James Bullard is the president and CEO of the Federal Reserve Bank of St. Louis. In that role, he is a participant on the Federal Reserve’s Federal Open Market Committee (FOMC), which meets regularly to set the direction of U.S. monetary policy. He also oversees the Federal Reserve’s Eighth District, including activities at the St. Louis headquarters and its branches in Little Rock, Arkansas, Louisville, Kentucky, and Memphis, Tennessee. A noted economist and policymaker, Bullard makes Fed transparency and dialogue a priority on the international and national stage as well as on Main Street. He serves on the board of directors of the St. Louis Regional Chamber and the board of directors of Concordance Academy of Leadership, and he is a past board chair of the United Way U.S.A. Bullard is co-editor of the Journal of Economic Dynamics and Control, and a member of the Central Bank Research Association’s senior council. He is an honorary professor of economics at Washington University in St. Louis, where he also sits on the advisory council of the economics department and the advisory board of the Center for Dynamic Economics. A native of Forest Lake, Minnesota, Bullard received his doctorate in economics from Indiana University in Bloomington.

Meredith Covington is the manager of the Supervision Policy, Research and Analysis team at the Federal Reserve Bank of St. Louis. Previously, Covington led the Policy and Analysis team in the St. Louis Fed’s Community Development function. Prior to the Fed, Covington served as a director at the Center for Social Development at Washington University in St. Louis, and as the public policy and communications manager and development associate for Southern Bancorp Community Partners. Covington earned a bachelor’s degree in political science and pre-law at Spring Hill College and her master’s in public administration from the School of Public Service at DePaul University. She is currently pursuing a master’s degree in economics from University of Missouri-Columbia.

Luanne Cundiff is president and CEO of First State Bank of St. Charles, MO, where she leads the bank’s staff and board of directors to better serve the financial needs of community businesses, organizations, and individuals. Cundiff brings 27 years of banking experience to her role at First State Bank. She held a variety of positions in the industry before transitioning into a management role. Cundiff is also an industry leader at the state and national level, previously serving on the Board of Directors of the Missouri Bankers Association, Board of Directors of the American Bankers Association (ABA) and serving as Chair of the ABA Community Bankers Council. Cundiff is dedicated to helping St. Charles County align workforce needs with economic development efforts for current and future employers in the region. She has served as Chair for both the St. Charles County Workforce Development Board and the St. Charles County EDC Business & Community Partners. Passionate about giving back, Cundiff has a long history of supporting her community. Her leadership and service to more than a dozen local nonprofits include board member and treasurer of the Community and Children’s Resource Board and Barnes St. Peters/Progress West Hospital Foundation Board. Cundiff’s example of service to community is modeled by employees of First State Bank. Under her leadership, the bank has earned a reputation for supporting the communities it serves. Employee volunteer hours totaled more than 353 days with local nonprofits in 2019 and an additional 309 days in 2020 largely through virtual volunteer service needed in our local areas amid the pandemic. That spirit of commitment to exemplary service and personal contributions remains a core value of the First State Bank as Cundiff and the bank team continue to give back and strengthen our communities.

Tom Fite serves as the Director of the Indiana Department of Financial Institutions, a state regulatory department that supervises, charters and licenses financial service providers doing business in Indiana. As a lifelong public servant, Tom is excited to fulfill the Department’s mission. Now in his twenty-fourth year with the Department, Tom held many positions prior to being appointed Director in 2016. Tom represents state regulatory interests as a Federal Financial Institutions Examination Council member. He is a member of the FFIEC’s State Liaison Committee, a committee that he currently chairs. Recently, Tom was named Chairman of the Conference of State Bank Supervisors. Closer to home, Tom also chairs the Midwest Interagency Advisory Group, and he is chairman of the Indiana Executive Council on Cybersecurity Finance Committee. Tom supports the National Association of State Credit Union Supervisors as well, where he is a board member of the NISCUE education foundation.

Tom earned an undergraduate degree from Ball State University and a master’s degree in business administration from Indiana Wesleyan University. Tom and his wife of 21 years are raising their three children in Brownsburg, Indiana.

Mark J. Flannery has been the Bank of America Eminent Scholar in Finance at the University of Florida since 1989. He has published extensively, particularly in the areas of corporate finance and the financial regulatory process, particularly as it applies to banks in the U.S. and abroad.

Mark J. Flannery has been the Bank of America Eminent Scholar in Finance at the University of Florida since 1989. He has published extensively, particularly in the areas of corporate finance and the financial regulatory process, particularly as it applies to banks in the U.S. and abroad.His “hands on” regulatory experience most recently includes more than two years as the Chief Economist and Director of the Division of Economics and Risk Analysis at the U.S. Securities and Exchange Commission. In that position, he was involved in developing rules and regulations for the mutual fund industry, CDS trading standards, and various equity market and firm reporting requirements.

Professor Flannery previously worked with other U.S. regulatory agencies: part-time Senior Adviser to the Office of Financial Research from 2011-2014, the New York Fed’s Financial Advisory Roundtable (2006-2014) and the Federal Reserve System’s stress-test-related Model Validation Council (May 2012 –2014, chair 2013-2014). In 2003, he helped establish the FDIC’s Center for Financial Research and then served as co-director and senior adviser until 2007.

He holds economics degrees from Princeton (A.B.) and Yale (M.A., M.Phil., and Ph.D.) and has previously held faculty positions at the University of Pennsylvania and the University of North Carolina (Chapel Hill), and visiting positions at NYU, the London Business School, and the University of New South Wales. He served as president of the Financial Intermediation Research Society (FIRS) and the Financial Management Association. He was an editor of the Journal of Money, Credit and Banking from 2000-2005.

He has been recognized for excellence in both teaching and research. Current research interests include the stability of “shadow banking” institutions and mortgage borrowers’ ability to discipline lenders that have been sanctioned by their regulator overseers.

Jim Fuchs is a vice president at the Federal Reserve Bank of St. Louis, overseeing the operations of the bank’s Applications, Credit, Reserves, Statistics, Business Line Training Services, Quality Assurance, Digital Transformation Consulting, Supervision Policy Research and Analysis, and Supervision Outreach units. Fuchs also oversees a wide range of national outreach programs developed by the St. Louis Fed for community bankers and is a member of several Federal Reserve System workgroups focused on community banking issues. Fuchs also chairs the organizing committee the Federal Reserve/ Conference of State Bank Supervisors’/FDIC annual Community Banking Research Conference. Before joining the St. Louis Fed, Fuchs served as a banking policy adviser and directed financial communications for New York State Comptroller Thomas DiNapoli. Earlier, he was chief of staff to former New York State Banking Superintendent Diana Taylor and served as an advisor to New York City Mayor Michael Bloomberg. He is a former captain in the United States Air Force serving during Operations Desert Storm, Enduring Freedom, and Iraqi Freedom. Fuchs received his MBA from the University of Missouri-St. Louis and his Bachelor of Science from the U.S. Air Force Academy. He also earned a graduate certificate in communications from the University of Oklahoma and a teaching certificate in secondary mathematics from City College in New York. In addition, Fuchs is a graduate of the Department of Defense Information School and the American Academy of Dramatic Arts. He is also a graduate of the Stonier Graduate School of Banking at the University of Pennsylvania’s Wharton School of Business.

Janet Garufis began her distinguished banking career as a teller almost 50 years ago with Security Pacific Bank, now Bank of America. She rose through the ranks of retail banking and after completing the Security Pacific Management Training Program, successfully led retail banking, commercial banking and private banking organizations.

Janet Garufis began her distinguished banking career as a teller almost 50 years ago with Security Pacific Bank, now Bank of America. She rose through the ranks of retail banking and after completing the Security Pacific Management Training Program, successfully led retail banking, commercial banking and private banking organizations.She was born in Los Angeles and graduated from Marymount High School. She attended UCLA and holds B.A. and M.A. degrees from California State University Northridge. She moved to Santa Barbara in 2002 to attend the Gevirtz Graduate School of Education, UC Santa Barbara to earn a Ph.D. Her educational pursuits were put on hold when she joined Montecito Bank & Trust in 2004. In 2006 she became CEO & President and in 2017 accepted the role of Chairman of the Board and continues her role as CEO. In 2022 Fielding University awarded Janet the Honorary Degree of Doctor of Philosophy in Humane Letters for her leadership and contributions to Fielding and the community.

Janet actively contributes her time and talent to local non-profits as well as industry associations. She currently chairs the Santa Barbara Symphony Board of Directors, and serves on the Sansum Board of Trustees (past Chair), the Scholarship Foundation of Santa Barbara Board of Directors (past Chair) and the Board of the Santa Barbara South Coast Chamber of Commerce.

She has previously served in different capacities with Women’s Economic Ventures, CALM, United Way, Music Academy of the West, the Santa Barbara Library, California State University Channel Islands, Habitat for Humanity, Fielding University, American Heart Association, PublicSquare and many others.

She also serves on industry boards including the Pacific Business Management Institute of Pacific Coast Banking School and the Board of the American Bankers Association Foundation Board. She has previously served on the Community Depository Institutions Advisory Council of the Federal Reserve Bank’s 12th District (CDIAC) and served as the Chair of the council in 2017 and 2018 and as the National CDIAC Chair in 2018.

In her spare time, Janet enjoys running, gardening and cooking. She loves spending time with her two sons and their families…especially her grandchildren!

Awards and accolades include: Santa Barbara Woman of the Year (2017), American Banker – 25 Most Powerful Women to Watch (2015, 2017), Pacific Coast Business Times - Top 50 Women in Biz (2007 – 2021), California State University Northridge Distinguished Alumna of the Year 2018, Pacific Coast Business Times Inaugural Distinguished Achievement Award (2018), Association of Fundraising Professionals – Volunteer of the Year (2015), United Way Abercrombie Community Excellence Award (2015), American Heart Association - Lifestyle Change Award (2013), Girls Inc. (Carpinteria) - Women of Inspiration Award (2012), Santa Barbara Chamber Businesswoman of the Year (2010), and Pierre Claeyssens Award for Distinguished Service (2010).

Esther L. George is president and CEO of the Federal Reserve Bank of Kansas City and a member of the Federal Open Market Committee, which sets U.S. monetary policy. She has more than 30 years of experience at the Kansas City Fed, primarily focused on regulatory oversight of 170 state-chartered banks and nearly 1,000 bank and financial holding companies in seven states. George was directly involved in the banking supervision and discount window lending activities during the banking crisis of the 1980s and post-9/11. During the most recent financial crisis, she served as the acting director of the Federal Reserve’s Division of Banking Supervision and Regulation in Washington, D.C. She is a native of Faucett, Mo.

Esther L. George is president and CEO of the Federal Reserve Bank of Kansas City and a member of the Federal Open Market Committee, which sets U.S. monetary policy. She has more than 30 years of experience at the Kansas City Fed, primarily focused on regulatory oversight of 170 state-chartered banks and nearly 1,000 bank and financial holding companies in seven states. George was directly involved in the banking supervision and discount window lending activities during the banking crisis of the 1980s and post-9/11. During the most recent financial crisis, she served as the acting director of the Federal Reserve’s Division of Banking Supervision and Regulation in Washington, D.C. She is a native of Faucett, Mo.

Martin Gruenberg is the chairman of the FDIC Board of Directors. He has been a member of the FDIC Board since August 2005 and previously served as Vice Chairman from August 2005 to July 2011 and as Chairman from November 2012 to mid-2018. He has also served as Acting Chairman on a number of occasions. Prior to joining the FDIC, Gruenberg served as senior counsel to Sen. Paul S. Sarbanes (D.-Md.) on the staff of the Senate Committee on Banking, Housing, and Urban Affairs from 1993 to 2005. He also served as staff director of the Banking Committee's Subcommittee on International Finance and Monetary Policy from 1987 to 1992. In addition, he served as chairman of the Federal Financial Institutions Examination Council from April 2017 to June 2018. Beginning February 15, 2022, Gruenberg assumed the role of chairman of the Resolution Steering Group (ReSG) of the Financial Stability Board. Since June 2019, Gruenberg has served as chairman of the board of directors of the Neighborhood Reinvestment Corporation (NeighborWorks America), and he has been a board member since April 2018. He received his Juris Doctor from Case Western Reserve Law School and his Bachelor of Arts from Princeton University, Princeton School of Public and International Affairs.

Gregory T. Hayes is the president and chief operating officer (COO) of Kish Bank, Belleville, Pa. Over his career, Hayes has served in various roles of increasing responsibility at Kish, including teller, management trainee, branch manager and retail lender, commercial lender, vice president of lending services, senior vice president of client solutions, executive vice president and head of retail banking and client solutions. Most recently, he served as senior executive vice president and COO. Hayes is a graduate of Lafayette College, Easton, Penn., where he earned a Bachelor of Science in mechanical engineering. He also graduated with honors from both the PA Bankers’ school of commercial lending and its advanced school of banking. Prior to joining Kish, he was a mechanical services engineer and a supervisor at Merck and Co. outside of Philadelphia, where he managed the construction and startup of Merck’s cervical cancer vaccine manufacturing facility. Active in the community, Hayes is chair of the board of the Bob Perks Fund, which financially supports individuals and families battling cancer in Blair, Centre, Clearfield, and Huntingdon counties. He is also a director of the PA Bankers’ advanced school of banking. In 2011, he received the Centre County Community Foundation’s “Future of the Foundation Award” for his extraordinary commitment to the community, including leadership roles with Habitat for Humanity, the YMCA and the Palmer Museum of Art at The Pennyslvania State University.

Amanda Heitz is an assistant professor of finance at Tulane University’s A.B. Freeman School of Business and an FDIC Visiting Scholar. Her research interests are primarily in banking, financial regulation, and corporate social responsibility. Inspired by her year visiting the FDIC, her recent work has centered around failed banks and the unintended consequences of company-run stress tests. Her research has been published in multiple journals, and she has received several best paper awards. Heitz received her Ph.D. in Finance from the University of Minnesota’s Carlson School of Management and a M.S. in Statistics, M.S. in Applied Math, and B.S. in finance all from the University of Illinois at Urbana Champaign.

Amanda Heitz is an assistant professor of finance at Tulane University’s A.B. Freeman School of Business and an FDIC Visiting Scholar. Her research interests are primarily in banking, financial regulation, and corporate social responsibility. Inspired by her year visiting the FDIC, her recent work has centered around failed banks and the unintended consequences of company-run stress tests. Her research has been published in multiple journals, and she has received several best paper awards. Heitz received her Ph.D. in Finance from the University of Minnesota’s Carlson School of Management and a M.S. in Statistics, M.S. in Applied Math, and B.S. in finance all from the University of Illinois at Urbana Champaign.

Ruidi Huang is an Assistant Professor of Finance at the Edwin L. Cox School of Business at Southern Methodist University. His research focuses on empirical corporate finance, entrepreneurship, and household finance using big data and machine learning techniques. His recent research uncovers gender, race, and income inequalities and their impact and consequences. His work has been published in leading academic journals in finance and has been covered in various media outlets, such as Forbes. He has presented his work at more than 20 universities as well as numerous national and international conferences. Huang received a Ph.D. in Finance from the University of Illinois at Urbana-Champaign in 2019 and a B.A. in Economics from Brigham Young University in 2013.

Amy Hutton is a Professor at Boston College’s Carroll School of Management. Prior to joining the Carroll School, she was on the faculty at the Tuck School of Business Administration at Dartmouth College and the Harvard Business School. Professor Hutton has a Ph.D. in Business Administration from The Simon Business School at the University of Rochester, with written qualifiers in Accounting, Finance and Organizations & Markets. Her research areas include: methods for detecting earnings management, the role of effective corporate governance and disclosure strategies, the role of reputation building in voluntary corporate disclosures, empirical assessments of valuation methods, and the roles of capital market intermediaries and regulators in determining market values of company stocks. As a result of her research on the conflict of interests facing sell-side analysts, Professor Hutton was named to the 2001 Congressional Review Board, opining on the Securities Industry Association’s “best practices for equity research.” Her research was used in the development of the Global Analyst Research Settlement: https://www.sec.gov/news/speech/factsheet.htm. In 2010, Professor Hutton won the Distinguished Contributions to Accounting Literature Award for her ‘Groundbreaking Research” demonstrating how strong corporate governance combats earnings management. She also served on the Board of Directors of Bandag, Inc. (a Fortune 1500 company), where she was appointed chairman of the Audit Committee. With over 30,000 Google Scholar citations, Professor Hutton’s work has appeared in publications such as the Journal of Accounting and Economics, the Accounting Review, Contemporary Accounting Research, the Journal of Accounting Research, the Journal of Financial Economics, the Review of Accounting Studies, the Harvard Business Review and the Journal of Applied Corporate Finance. She served as an Editor for The Accounting Review from 2011-2014.

Erica Jiang is an assistant professor of finance and business economics at the University of Southern California, Marshall School of Business. She obtained her Ph.D. in finance from the University of Texas at Austin in 2020. She is visiting the University of Chicago as a visiting assistant professor of finance during 2022-2023. Her research focuses on banking, household finance, and financial regulation. Her recent work studies the distributional effects of the supply-side adjustments in response to the rise of shadow banks, digital disruption, and changing regulatory environment.

Rhoshunda Kelly was appointed by Governor Tate Reeves to serve as the Commissioner of the Department of Banking and Consumer Finance on March 22, 2021. Kelly has over 20 years of experience as a regulator, beginning her career with the Department as a bank examiner trainee in 2001. She was a field examiner from 2001 to 2011 and became a review examiner in 2012. Kelly was promoted to the Director of Bank Supervision in 2013 and appointed Deputy Commissioner in 2014. As Deputy Commissioner, Kelly managed the banking, mortgage, consumer finance, administration, legal and information technology divisions. She also ensured effective coordination between the state and federal regulators and fostered engagement with regulated industries.

As Commissioner, Kelly ensures effective agency operations and oversees $154 billion in state-chartered banking assets. She also ensures the licensure and supervision of over 8,000 consumer finance and mortgage licensees, which represent 11 financial industries.

Kelly received her undergraduate degree in business with a concentration in Banking and Finance from Mississippi State University. She is a graduate of the Graduate School of Banking at Louisiana State University where she is a past instructor. Kelly is also an honor graduate of the American Bankers Association Graduate Trust School. She serves as a member of the Mississippi Certified Public Manager Advisory Board. Kelly is Vice-Chair of Mississippi State University Finance and Economics Advisory Board and was named a 2019 Leader in Finance by Mississippi Business Journal.

Kelly is active in the Conference of State Bank Supervisors (CSBS) and was recently elected as the Chair Elect of the Executive Committee and Board of Directors.

Lise Kruse is the current Chair of the Conference of State Bank Supervisors (CSBS) and the commissioner of the North Dakota Department of Financial Institutions. She was named commissioner in 2017. She joined the Department of Financial Institutions as a financial institutions examiner in 2004 and was promoted to chief examiner-banks in 2011. Prior to joining the DFI, she worked for a life insurance company in Fargo, ND. She received a Bachelor of Arts with majors in business and organizational communication from Concordia College, Moorhead, Minn. And her MBA with an emphasis in information technology from the University of Colorado, Colorado Springs, Colorado. Kruse is also a graduate of the Graduate School of Banking at Colorado, Boulder, Colorado. In 2020, Kruse was elected by her peers to serve on the CSBS executive board. She also serves on the Federal Deposit Insurance Corporation Regulatory Advisory Board.

Scott Langford is a post-doctoral research fellow in the School of Public Affairs at Arizona State University. He completed his Ph.D. in Public Policy at the University of North Carolina at Chapel Hill in 2022, where he was also a researcher at CREATE, an economic development research center affiliated with the Kenan Institute of Private Enterprise at Kenan-Flagler Business School. The central thread of his research is the investigation of how local finance and public health conditions affect entrepreneurship and economic development.

Clayton Legear, president and CEO of Pascagoula, Mississippi-based Merchants and Marine Bank (MMB), joined MMB in 2011 as a compliance manager and chief risk officer and rose through the ranks to become president and CEO in 2019. In August 2021, he was appointed to the Mississippi State Board of Banking Review by Governor Tate Reeves to fill one of two seats on the board reserved for active officers or directors of state-chartered banks. Legear is also involved with several civic, charitable and professional organizations throughout the Gulf Coast region, including Leadership Mississippi, the United Way and the Gulf Coast Business Council. Prior to joining MMB, Legear served as an examiner and deposit insurance claims specialist with the Federal Deposit Insurance Corporation (FDIC).

Legear holds a Bachelor of Science in business administration from Troy University, Troy, Alabama, where he graduated Magna Cum Laude. He also holds a Graduate Banking Certificate from the Graduate School of Banking of the South at Louisiana State University.

Xiang Li is a finance Ph.D. candidate at Boston College. He holds a bachelor's degree in economics from Wuhan University, China. Xiang's current research interests are in banking and entrepreneurship. His most recent research analyzes how bank competition narrows gender and racial gaps in entrepreneurship by reducing discrimination.

Xiang Li is a finance Ph.D. candidate at Boston College. He holds a bachelor's degree in economics from Wuhan University, China. Xiang's current research interests are in banking and entrepreneurship. His most recent research analyzes how bank competition narrows gender and racial gaps in entrepreneurship by reducing discrimination.

Nicole S. Lorch joined First Internet Bank in February 1999 and has held leadership roles in relationship banking, marketing and technology. She was named Chief Operating Officer in January 2017 and was appointed President in July 2021. In her current role, she is responsible for executing the bank’s strategic plan by aligning human capital, technology resources and business processes.

Nicole S. Lorch joined First Internet Bank in February 1999 and has held leadership roles in relationship banking, marketing and technology. She was named Chief Operating Officer in January 2017 and was appointed President in July 2021. In her current role, she is responsible for executing the bank’s strategic plan by aligning human capital, technology resources and business processes.

Ms. Lorch serves on advisory boards for the Indianapolis Neighborhood Housing Partnership (INHP) and the Hamilton County (Indiana) Community Foundation.

Ms. Lorch earned a bachelor’s degree from DePauw University and an MBA from Indiana University – Kelley School of Business and is a 2015 graduate of the CBA Executive Banking School.

Jordan A. Miller, Jr. is a Business and Community Advisor and currently resides in Columbus, Ohio. He is a leader in the Columbus community and serves on several boards and fundraising initiatives. He is currently working with his business partners to form a new bank. The proposed bank is Adelphi Bank and if successful he will be the Chairman and CEO. Prior to this new venture, he was the Regional Chairman at Fifth Third Bank of Central Ohio and leader of the local Advisory Board. His focus was to expand the Bank’s footprint in the Commercial, Consumer, and Wealth Management areas. He was also committed to the Bank’s efforts to expand affordable housing and help women and minority owned businesses gain access to capital.

During his career at Fifth Third Bank, his other roles included President and CEO of the Central Ohio region, President and CEO of Fifth Third Securities Inc. (a full service investment and Brokerage) and senior vice president and manager of Fifth Third Investment Advisors (Cincinnati).

Prior to Fifth Third, Jordan served as chief financial officer and business manager for another regional Bank in Columbus, Ohio. He started his banking career as a bank examiner with the Office of the Comptroller of the Currency.

Education

Jordan earned his bachelor’s degree in finance from the University of Maryland in College Park. In September 2013, he was awarded an honorary doctorate of community leadership from Franklin University in Columbus.

Professional and Civic

Jordan serves as a board member of the Columbus Regional Airport Authority, Nationwide Children’s Hospital, the Columbus Metropolitan Library. He is a member of the Columbus City Schools Finance and Appropriations Committee and a member of the Board of PACT for development of the east side. He is also on the Board of 2 for profit companies.

He is a former member of the Federal Reserve Bank of Cleveland – Columbus Business Advisory Council, the Ohio Banking Commission, The Columbus Partnership, the Columbus Chamber of Commerce, The United Way of Central Ohio and the Columbus Downtown Development Corp. He was a Co-Chair of the fundraising of the Central Ohio Boys and Girls Club. He is also past chair of several campaigns, including the United Ways of Central Ohio, the American Heart Association Heart Ball, March of Dimes Walk for Babies, Prevent Blindness and The Ohio Foundation of Independent Colleges. He recently co-chaired the Columbus City School millage committed for a planned levy. He also is the recipient of numerous community awards and was inducted into the Junior Achievement of Central Ohio Business Hall of Fame.

Allison Nicoletti joined the Wharton School of the University of Pennsylvania as an assistant professor of accounting in 2016. She holds a Ph.D. in accounting from The Ohio State University and a bachelor’s degree in accounting and economics from Illinois Wesleyan University. Prior to returning to academia, she was a senior audit associate in financial services at KPMG in Chicago, Ill., focusing on financial statement audits of bank and insurance companies and is a certified public accountant licensed in Illinois. Her research examines financial reporting and disclosure decisions made by financial institutions as well as the economic consequences of accounting standards and regulation.

Allison Nicoletti joined the Wharton School of the University of Pennsylvania as an assistant professor of accounting in 2016. She holds a Ph.D. in accounting from The Ohio State University and a bachelor’s degree in accounting and economics from Illinois Wesleyan University. Prior to returning to academia, she was a senior audit associate in financial services at KPMG in Chicago, Ill., focusing on financial statement audits of bank and insurance companies and is a certified public accountant licensed in Illinois. Her research examines financial reporting and disclosure decisions made by financial institutions as well as the economic consequences of accounting standards and regulation.

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. He was reappointed and sworn in on June 16, 2014, for a term ending Jan. 31, 2028. Prior to his appointment, Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C., where he focused on federal and state fiscal issues. From 1997 through 2005, Powell was a partner at The Carlyle Group. Powell served as an assistant secretary and as undersecretary of the Treasury under President George H.W. Bush, with responsibility for policy on financial institutions, the Treasury debt market and related areas. Prior to joining the administration, he worked as a lawyer and investment banker in New York City. He received an A.B. in politics from Princeton University in 1975 and earned a law degree from Georgetown University in 1979. While at Georgetown, he was editor-in-chief of the Georgetown Law Journal.

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. He was reappointed and sworn in on June 16, 2014, for a term ending Jan. 31, 2028. Prior to his appointment, Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D.C., where he focused on federal and state fiscal issues. From 1997 through 2005, Powell was a partner at The Carlyle Group. Powell served as an assistant secretary and as undersecretary of the Treasury under President George H.W. Bush, with responsibility for policy on financial institutions, the Treasury debt market and related areas. Prior to joining the administration, he worked as a lawyer and investment banker in New York City. He received an A.B. in politics from Princeton University in 1975 and earned a law degree from Georgetown University in 1979. While at Georgetown, he was editor-in-chief of the Georgetown Law Journal.

Daniel Rabetti is a financial economist pursuing a P.hD in Business at Tel Aviv University, and currently visiting Cornell University. Daniel research interest lies in the intersection of financial innovation and disclosure - as means to mitigate asymmetric information in alternative financing markets. He has been working on several academic research in the field of economics of blockchain, industrial organization, and disclosure in unregulated markets. Daniel work has been featured in prominent conferences in accounting, finance, computer science, blockchain, and economics, and his work is currently on the path for publication in distinguished peer-reviewed academic journals.

Daniel Rabetti is a financial economist pursuing a P.hD in Business at Tel Aviv University, and currently visiting Cornell University. Daniel research interest lies in the intersection of financial innovation and disclosure - as means to mitigate asymmetric information in alternative financing markets. He has been working on several academic research in the field of economics of blockchain, industrial organization, and disclosure in unregulated markets. Daniel work has been featured in prominent conferences in accounting, finance, computer science, blockchain, and economics, and his work is currently on the path for publication in distinguished peer-reviewed academic journals.

Website - https://www.danielrabetti.me

Joey Samowitz is senior director of policy development with the Conference of State Bank Supervisors (CSBS). At CSBS, he leads a team of analysts in crafting policy positions and managing workflows to inform action by state regulators. He provides thought leadership in several interagency groups and formerly represented the states on the FSOC digital asset working group. He is also the staff lead on the CSBS Bankers Advisory Board and provides key research on complex topics like digital assets, and regulatory proposals. He received his bachelor’s degree from the University of Maryland and is a graduate of the Graduate School of Banking at Colorado. Joey is currently studying for his MBA at the University of Nebraska-Lincoln. Joey joined CSBS in 2017.

Thomas Siems is the chief economist with the Conference of State Bank Supervisors (CSBS). He joined CSBS in 2019 after serving 34 years at the Federal Reserve Bank of Dallas and more than 20-year teaching at Southern Methodist University in Dallas. Siems earned a Bachelor of Science in industrial and operations engineering from the University of Michigan and his Master of Science and Ph.D. degrees in operations research from Southern Methodist University. Siems is also a graduate of the Graduate School of Banking at Colorado and has published more than 75 articles in academic, Federal Reserve and referred journals. He delivered a 2015 TEDxSMU Talk, “The Wealth of Innovations,” and has authored five children’s picture books, including “The Dangerous Pet,” which poetically helps readers understand the dangers of debt.

Brian Sullivan is a senior media relations officer with the Federal Deposit Insurance Corp. (FDIC) and host of the FDIC Podcast. For more than 20 years, he has served in the public sector as a spokesperson and public affairs specialist for the FDIC, the U.S. Department of Housing and Urban Development (HUD), and the Federal Housing Administration (FHA). Prior to his government experience, Sullivan spent the first 20 years of his professional career in broadcasting, which included reporting, editing and producing local and national news at Milwaukee Public Radio, the former Mutual Broadcasting System, Westwood One, NBC Radio and WJLA-TV in Washington, D.C. He received his Bachelor of Arts in journalism from the University of Wisconsin-Madison. Growing up in the D.C. area, Sullivan will tell you he got his real start in the media early on when he delivered newspapers for the Washington Post and Evening Star.

Amanda Swoverland has built her career at the intersection of risk, compliance, and innovative financial services solutions. Over 20 years as a bank examiner, consultant, BSA officer, and Compliance Officer, Amanda has developed and articulated a philosophy that compliance departments can help clients build great products that embed rules and reduce frictions rather than being departments of “no.” Prior to joining Unit, Amanda spent nine years building and leading a team of compliance and risk professionals at Sunrise Banks, based in Minnesota. As Sunrise’s Chief Risk Officer, Amanda helped transform the organization into a highly regarded sponsor bank in the prepaid and fintech markets, serving innovative clients like Remitly, Gusto, and Self Lender.

Amanda is a regular speaker at fintech and regulatory conferences, including LendIt, the Financial Health Network’s Emerge Forum, and FINEXT. She attended the Global Alliance for Banking on Values Leadership Academy and the Graduate School of Banking at Colorado’s Executive Development Institute.

Oktay Urcan is professor of accountancy and Fred & Virginia Roedgers Faculty Fellow in Accountancy. He joined the University of Illinois at Urbana-Champaign in 2014 after being an assistant professor for seven years at London Business School and, before that, a teaching assistant for five years at the University of Texas at Dallas. His research interests include archival financial accounting: debt market relevance of accounting information, accounting disclosures, and macro accounting. He has made the List of Teachers Ranked as Excellent at the University of Illinois several times, and received the Raymond A. Hoffman Faculty Excellence Award in Accountancy in 2016. Urcan received his BA in management from Bogazici University in 2002 and his PhD in accounting from the University of Texas at Dallas in 2007.

Cindy Vojtech is a principal economist in the Stress Testing Research section of the Division of Supervision and Regulation at the Federal Reserve Board (https://www.federalreserve.gov/econres/cindy-m-vojtech.htm), where she co-leads two teams in the national Stress Testing Program. Prior to joining stress testing, she worked in bank-focused sections in the Division of Financial Stability and the Division of Monetary Affairs. Her research interests include financial institutions and the effects of regulation. Since 2013, Cindy has also been a lecturer at the Krieger School of Arts and Sciences at Johns Hopkins University. She joined the Board in 2011 after receiving her Ph.D. in Economics from the University of California, San Diego. Prior to graduate studies, Cindy worked as an economist at the Bureau of Economic Analysis and as an investment banking analyst at Lehman Brothers. She received her bachelor’s degree from the Gabelli School of Business, Fordham University, graduating as a valedictorian. In college, Cindy played for the varsity volleyball team all four years and rowed for the varsity crew team her senior year. She was named first team GTE/CoSIDA Academic All-America® for volleyball and crew.

Cindy Vojtech is a principal economist in the Stress Testing Research section of the Division of Supervision and Regulation at the Federal Reserve Board (https://www.federalreserve.gov/econres/cindy-m-vojtech.htm), where she co-leads two teams in the national Stress Testing Program. Prior to joining stress testing, she worked in bank-focused sections in the Division of Financial Stability and the Division of Monetary Affairs. Her research interests include financial institutions and the effects of regulation. Since 2013, Cindy has also been a lecturer at the Krieger School of Arts and Sciences at Johns Hopkins University. She joined the Board in 2011 after receiving her Ph.D. in Economics from the University of California, San Diego. Prior to graduate studies, Cindy worked as an economist at the Bureau of Economic Analysis and as an investment banking analyst at Lehman Brothers. She received her bachelor’s degree from the Gabelli School of Business, Fordham University, graduating as a valedictorian. In college, Cindy played for the varsity volleyball team all four years and rowed for the varsity crew team her senior year. She was named first team GTE/CoSIDA Academic All-America® for volleyball and crew.

Gregory Weitzner is an Assistant Professor of Finance at McGill University where he research focuses on empirical and theoretical issues in financial intermediation. His most recent research analyzes how asymmetric information affects local bank lending markets. He received a PhD in Finance from UT Austin and a bachelor's and master's degree in economics from Boston University. Prior to his PhD I worked for two years in investment banking in New York City.

Carl White is the senior vice president of the Supervision, Credit, Community Development and Learning Innovation division at the Federal Reserve Bank of St. Louis. White has more than 35 years of experience in the Supervision Division of the Federal Reserve Bank of St. Louis. He is currently senior vice president of the Supervision, Credit and Learning Innovation Division. He has served in various other roles within Safety and Soundness, beginning his career as an examiner. Mr. White has served as lead instructor and course developer on numerous Fed System training courses, including an international assignment in Brazil. In addition, he served as the central point of contact for the District’s largest state member bank before and during the financial crisis. He and his team were nominated for the District’s President’s Award for Innovation as a result of efforts to implement and enhance off-site loan review and examination processes. Mr. White holds a bachelor’s degree with a major in finance from St. Louis University.

Video Gallery